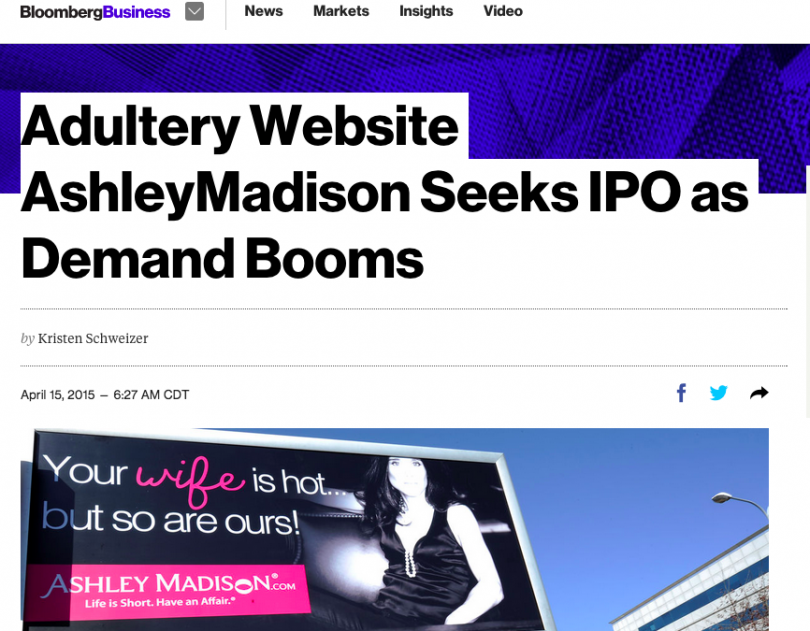

aNewDomain — On April 15, 2015, BloombergBusiness ran with an exclusive story that Avid could be soon floating an IPO on the London Stock Exchange (LSE) because of “booming demand.” Headlined “Adultery Website Ashley Madison Seeks IPO as Demand Booms,” the piece says that Ashley Madison’s parent, Avid, would be seeking to raise $200 million on a company valuation of $1 billion.

— On April 15, 2015, BloombergBusiness ran with an exclusive story that Avid could be soon floating an IPO on the London Stock Exchange (LSE) because of “booming demand.” Headlined “Adultery Website Ashley Madison Seeks IPO as Demand Booms,” the piece says that Ashley Madison’s parent, Avid, would be seeking to raise $200 million on a company valuation of $1 billion.

Was there anything to this story? To get the answer, we analyzed some of the 20GB worth of leaked Ashley Madison emails allegedly sent to and by (then) Avid CEO Noel Biderman.

The first clue pops up on April 15, 2015, a couple of hours after Bloomberg published that first piece about Avid’s sought-for IPO on the LSE.

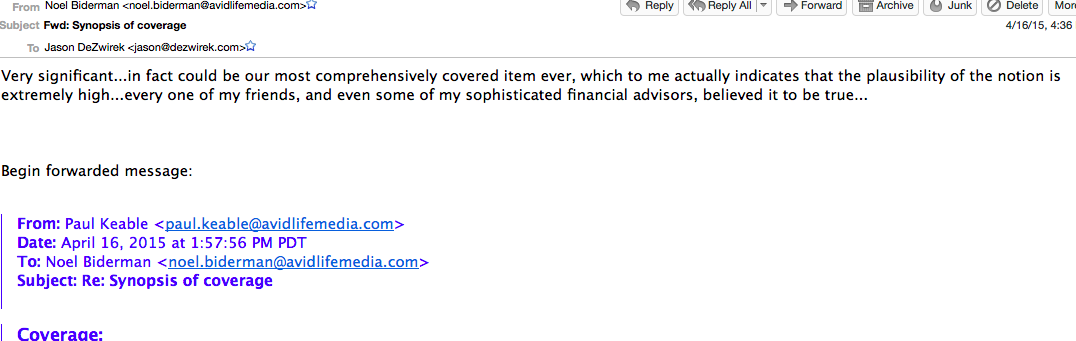

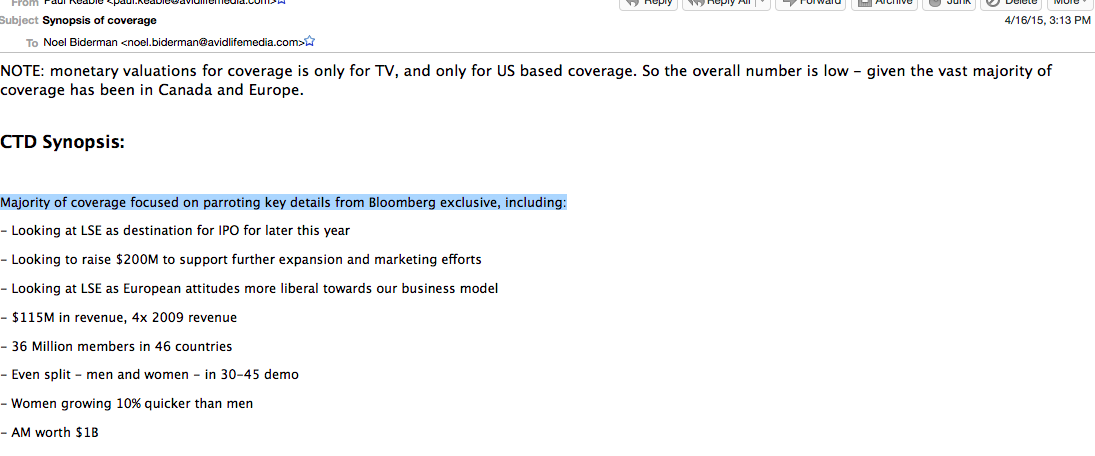

In the message, Avid VP of communications, Paul Keable, summed up coverage for execs. So far, he wrote, there were: “Eight print articles (including the Globe and Mail, the New York Post and La Presse), dozens of online articles, seven radio spots and some 22 TV pieces, which he valued at about $145,000 in impressions. Not much considering,” he wrote. But Biderman, the leaked emails show, considered the Bloomberg piece and all the resulting copycat coverage to be “very significant.”

Why? The leaked emails allege Biderman explained, by saying, “Because people actually believed it!”

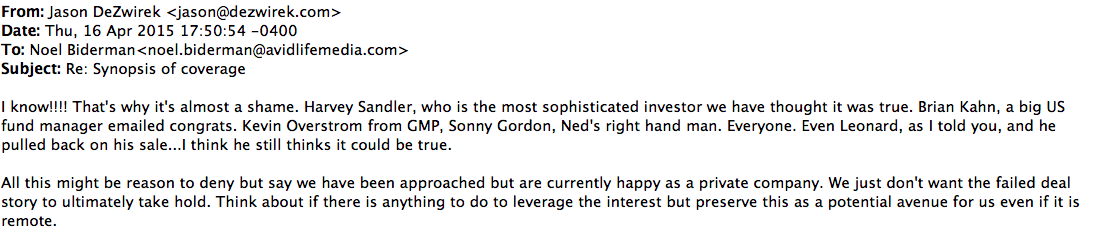

In an April 16 message to Jason DeZwirek, the firm’s largest owner at 30 percent, Biderman allegedly noted that even some of his “sophisticated financial advisors … believed it to be true …”

Here’s how DeZwirek responded.

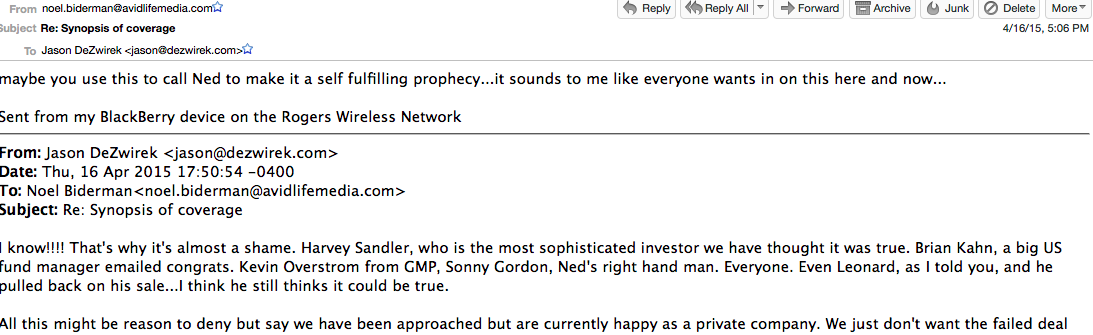

In Biderman’s alleged response to DeZwirek, he wondered whether Avid could use the BloombergUK leak “to make it a self fulfilling prophecy …”

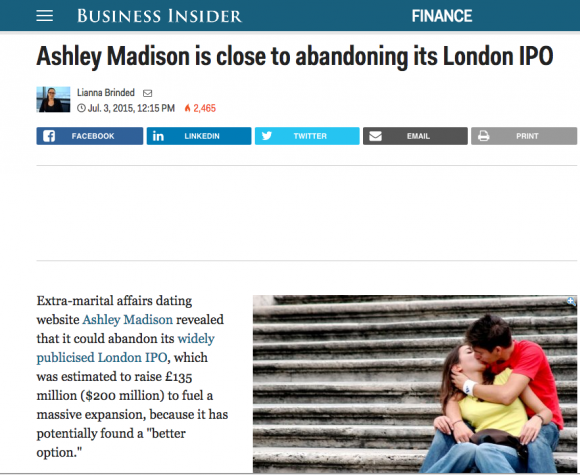

Per board suggestions that CEO Biderman “downplay” the London IPO story, Biderman began to de-emphasize the story in interviews, leaked emails allege. And on July 3, 2015, the job seemed done when the Business Insider (BI) announced that there would be no London IPO after all.

On that day, Business Insider reported that, nah, Avid had changed its mind. In an email to Avid management, communications VP Keable let everyone know that piece was up, just three minutes after BI posted it.

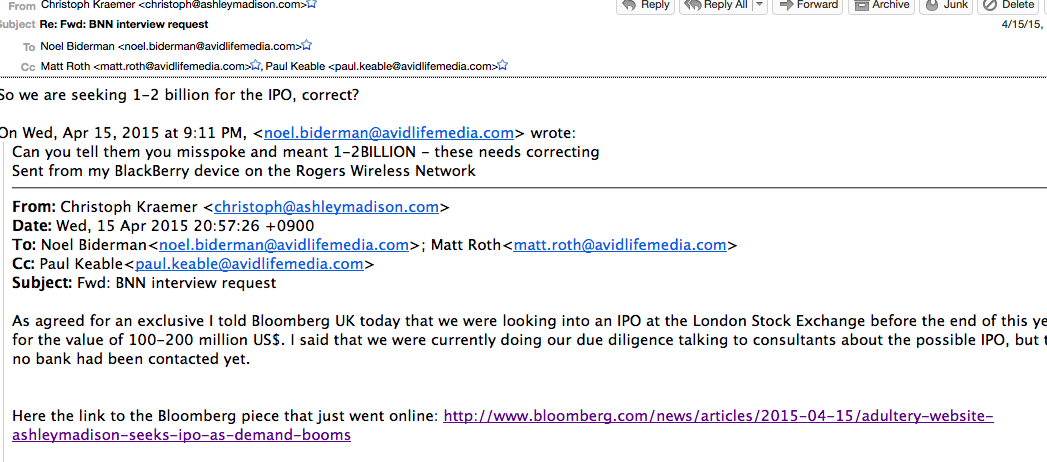

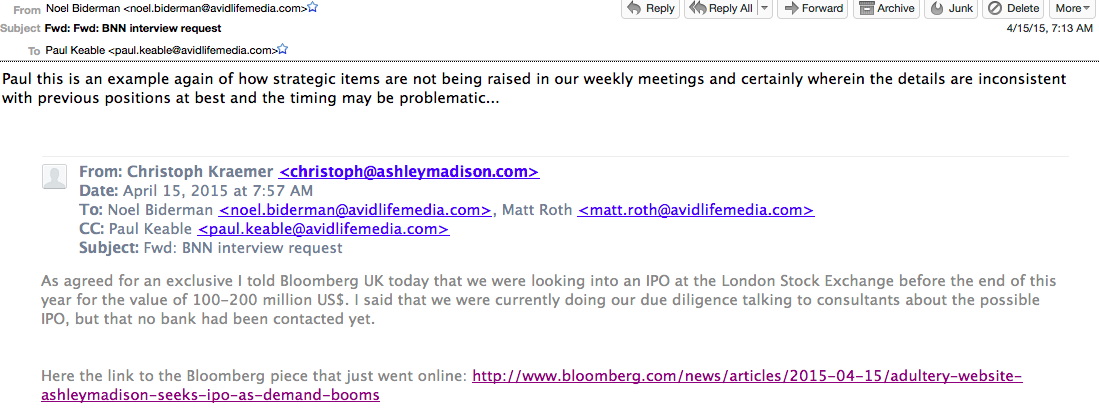

So how did BloombergUK get the planned London IPO story in the first place? And what was Avid thinking? Here’s what the Avid PR guy said about it, a leaked email alleges …

Avid’s former PR guy in Europe, Christoph Kraemer, “cleared” the idea with Paul Keable to give Bloomberg an exclusive on an “IPO story,” emails suggest.

You may recall, Kraemer was the “expert” quoted in that first Bloomberg article.

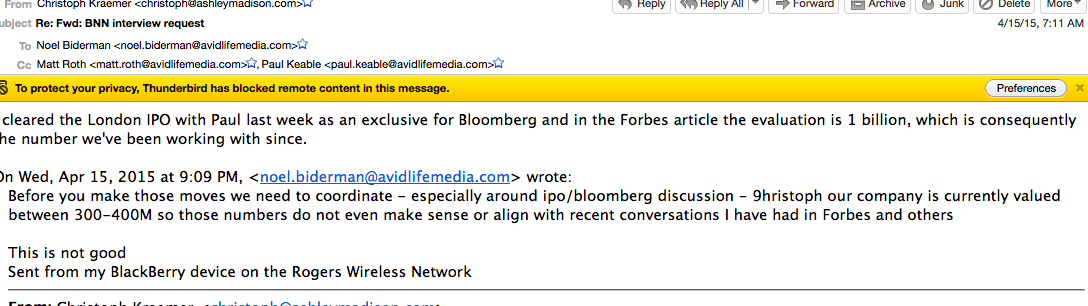

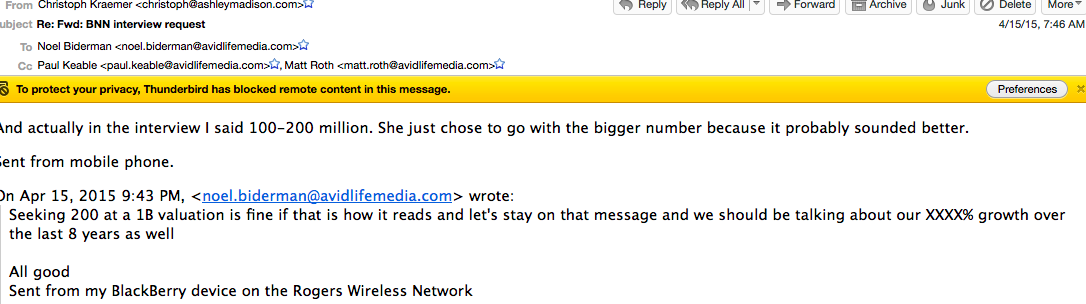

In the hours after BloombergUK published the story, though, not everything was right in paradise. In particular, calling the firm a “one billion” dollar company didn’t sit well with Biderman, another set of leaked emails allege …

And wait! A $1 billion valuation? Does that “even make sense?” a peeved Biderman allegedly asks.

The numbers, after all, “do not even make sense or align with recent conversations I have had in Forbes and others,” Biderman allegedly writes to Kraemer, right after learning of the BloombergUK piece …

But this message was cleared, the PR guy who leaked the IPO story allegedly responds (as you can see above).

To this reporter, it sounds like someone is in trouble, reveals this leaked email, allegedly sent by Biderman to his VP of communications, Keable, two minutes later.

Ah, never mind … PR guy’s job is rescued. Whew.

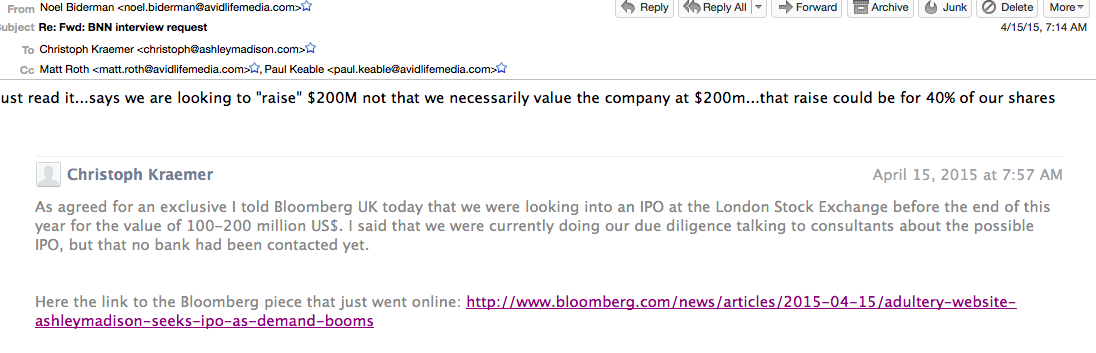

And … well … okay. “Seeking 200 at a 1B valuation is fine” after all, “if that is how it reads,” Biderman responds.

Even if the BloombergUK Ashley Madison IPO details were leaked and apparently had no basis in fact, how was it that 100-plus other online articles from major media covered the story, too?

Much like some of the far-fetched details around how the Impact Team got endlessly repeated and eventually accepted as the truth, the article was, let’s say, borrowed from a lot.

According to an Avid PR exec, “the majority of coverage focused on parroting” Bloomberg. Good thing journalists parrot a high profile story’s messaging and sourcing, isn’t it? PR is cheaper that way, presumably …

In the end the BloombergUK piece accomplished a few key Avid messages as listed above, according to the leaked Ashley Madison exec emails.

The BloombergUK article managed to get the message out that Ashley Madison was worth $1 billion, had 36 million members in 46 countries and that there was an even split in male and female members aged 30-45.

But, as you can see from the allegedly leaked emails, there wasn’t any real harm done … that is, Avid was able to take back the whole thing. Fully. And it was able to do this without, as DeZwirek had originally cautioned, making the whole London IPO thing sound like a “failed effort.”

But, as you can see from the allegedly leaked emails, there wasn’t any real harm done … that is, Avid was able to take back the whole thing. Fully. And it was able to do this without, as DeZwirek had originally cautioned, making the whole London IPO thing sound like a “failed effort.”

On July 3, Business Insider reported that, after a “two month roadshow Avid changed its mind. Forget London! There was a whole world of IPO opportunities for the high-flying Toronto company to explore,” the article said.

Dozens of Ashley Madison-focused stories run around the world weekly, if not daily, if one is to believe the weekly PR and marketing updates in the allegedly leaked email messages.

But the BI article got special exec notice. Six minutes after it posted, Avid VP of communications Keable made a point of getting the word out. “The BI story ran,” he said in a July 3 email with the whole of that article copied in.

Here’s an excerpt of the article:

Noel Biderman, CEO of Avid Life Media which owns Ashley Madison as well as a range of other niche dating websites, told Business Insider in a telephone interview that after a two-month roadshow, the number of potential options for the group’s shareholders has widened and now listing on a stock exchange isn’t necessarily the No.1 choice.

The last time we spoke to Biderman in April, he seemed pretty deadset on his company launching an IPO in London. But after courting a number of unnamed London banking giants, Biderman said they haven’t secured a bookrunner for the listing.

‘There is no change in securing a bank to lead an IPO but right now we are looking and assessing two different strategies. We can do a straight-up IPO, but since the news of the potential launch was made, we got a lot of attention and this has garnered a range of further options,’ said Biderman. ‘With the kind of income we generated over the last eight years and if we remain as profitable as we are now over the next eight years, it may be in our current shareholders’ interest for us to use an investment vehicle to give them set dividends. For example, investing $1 a year, would give you $1 in return the following year, rather than investing $1 and potentially getting $5 some time down the road.’

Does this mean Ashley Madison will abandon its IPO completely?

‘We are not a typical tech company and we have a subscriptions model. We never wanted to launch an IPO because we had to, or to get funding to keep the lights on, we just thought it was one of the best options for expanding and giving good returns to shareholders. We generate tens of millions in cash flows,’ said Biderman.”

Not a typical tech company?

You be the judge.

For aNewDomain, I’m Gina Smith.