aNewDomain — Christmas, Black Friday, Memorial Day and summer (you know, in general) all have two things in common: They are all great times to spend with your family, and they all have the potential to cost a lot of money. The balancing of your budget may not be the most fun thing to do, but sometimes it’s necessary.

The app Better Than Budgeting will help you get this done in the most-painless way possible. The idea for the app started as a book by Norbert D. Frank, which aimed to teach readers how to effectively manage their financial situation. The book was pretty successful, and now there are apps available for Android on Google Play, Apple iOS, Mac and Windows, all of which use financial concepts from the book to help users actively finance.

Track That Money

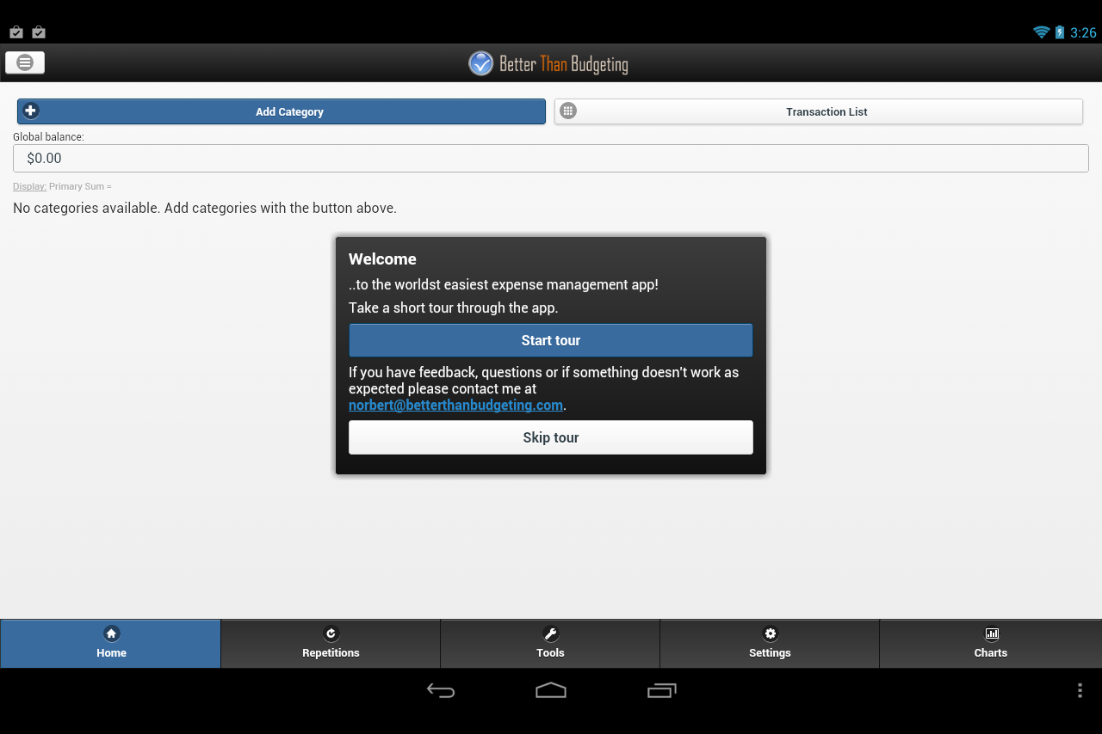

Many people have never been taught how to balance their budget, but it’s a life skill that everyone should be able to employ effectively. Better Than Budgeting sets out to educate the user in a straightforward and simple manner, but it does take a bit of work to set it up properly. The app has a very helpful program to guide you through setup, though, so let’s get started.

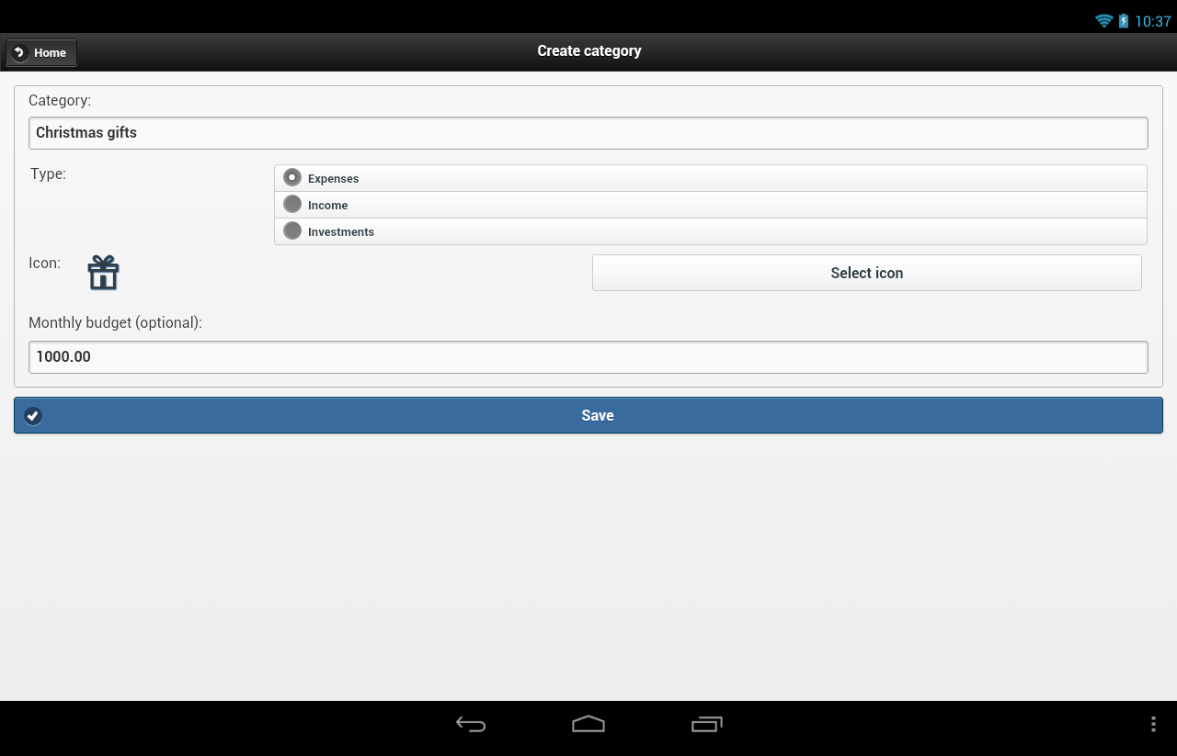

The app’s home screen is where most of the work will be done. You have to add your personal financial information, like expenses, investments, income and your specific budget with the “Add Category” button.

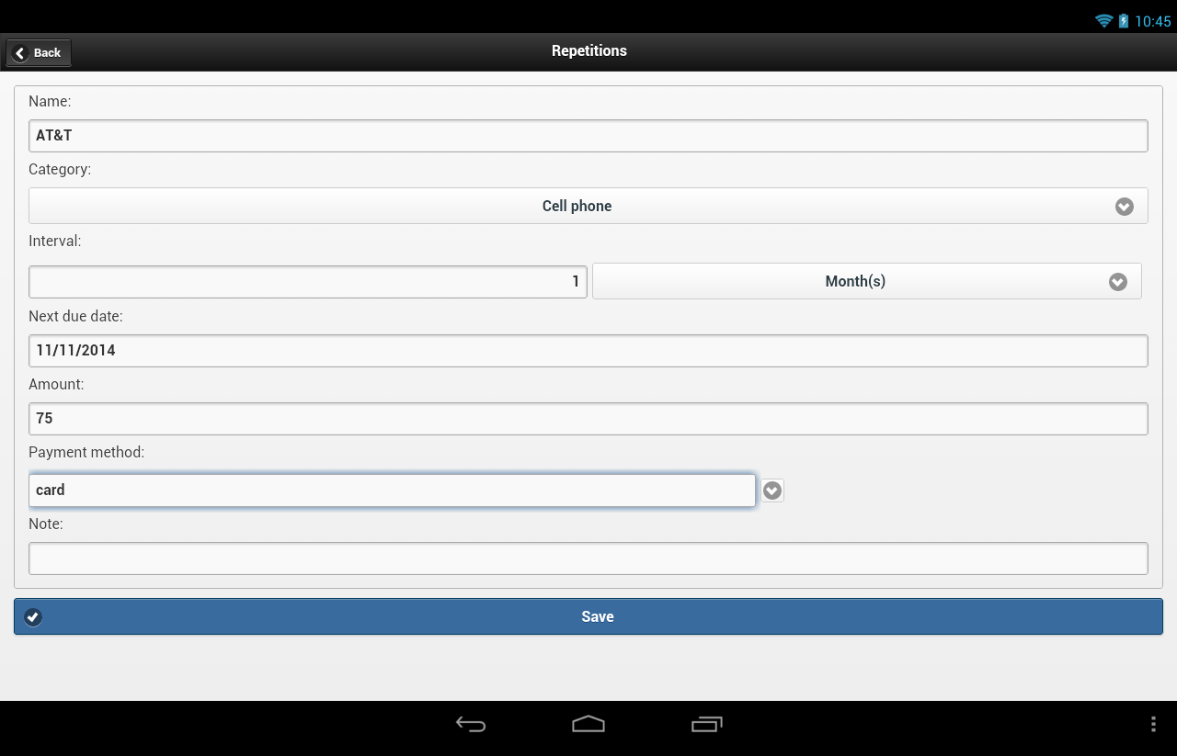

The Repetitions tab is where you can enter all those necessary (but unfortunate) recurring payments. You can put your car loans, mortgage loans, utilities, rent, cell phone bills and even student loans in there. This will help you save time and manage your stress because you won’t have to remember to add those expenses every month.

After you’ve entered all your general financial information you can begin to enter each transaction in real time. When you get in the habit of entering every transaction it becomes pretty clear how much you spend and, most importantly, that you aren’t spending way beyond your means. And, if you are, now you have a clear picture.

In the example below you can see my “Lottery payments” easily covers my monthly payments, but the holiday season is coming up, so I’ll need to keep an eye on that spending.

Better Than Budgeting also provides tools that allow you to transfer data between your desktop and mobile device. This synchronization is very useful and will assure that your budget won’t be riddled with overlooked expenditures.

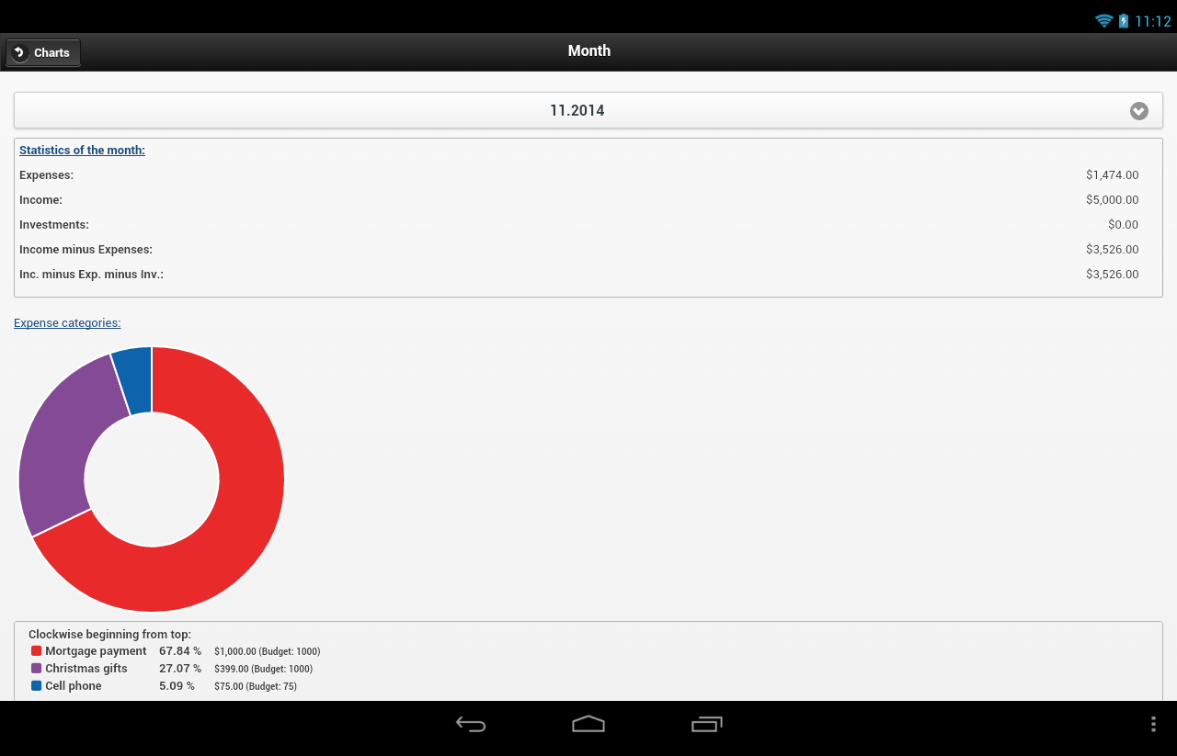

There’s also a Chart tab in the app that gives you a visual representation, in a pie chart, of your spending activity. I’ve found that seeing my budget visually helps me understand at a glance where all my well-earned money is going. You can’t change a bad habit until you notice it, and the pie chart can help with that.

You Owe Yourself

Successfully managing your finances sets you up with a strong foundation for everything life will throw at you. And it will throw things, of that I am sure. My formal training is as an accountant, and I have seen first-hand how poor financial management skills can create havoc in a person’s life. Do yourself a favor and take control of your finances somehow, someway.

I use Excel to track every financial transaction in my life because I was trained how to do it that way — it’s become second nature to me. But for those of you not trained in the accounting black arts, I think you will be very happy with the simple yet powerful tools offered by the Better Than Budgeting app.

For aNewDomain, I’m Mark Kaelin.

All Screenshots: Mark Kaelin

Header/Featured image: Budget by Simon Cunningham via Flickr