aNewDomain — If you’re looking to add a bit more stress to your life, consider buying a home.

Once you start looking at interest rates, credit scores and down payments, you might start wishing you paid a bit more attention in high school math. Thanks to the magic of the Internet, there are some great tools out there that will help take some of the sting out of all those numbers. The Zillow Mortgage Calculator for Android and iOS is one. This free app will infuse meaning into the seemingly endless list of house-purchasing variables so you can feel more confident about whatever you decide to buy.

That’s why it’s my selection for aNewDomain App of the Day.

Zillow Mortgage Calculator

Now, mortgage calculators aren’t a new invention. There have been Shareware versions since ancient times — you know, like the 1980s. I’ve even used Excel to create my own mortgage calculator — but that’s probably only because I’m an accountant.

And of course, there are a variety of mortgage calculators available for your tech devices. In my opinion, though, the Zillow Mortgage Calculator has a leg up on the competition. I love how it ties in real estate listings and real-time information for home buyers.

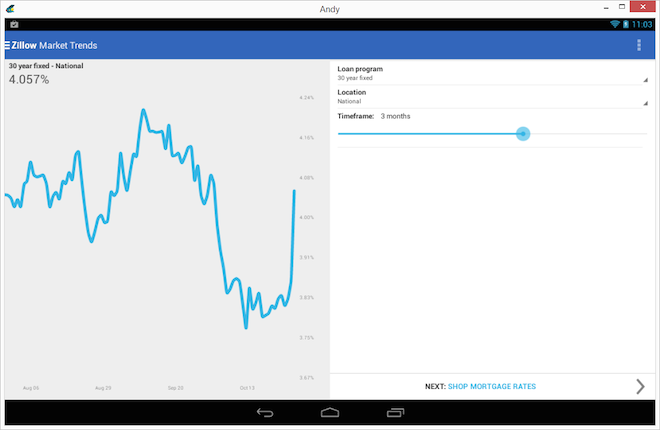

For example, when you start up the app, a screen will automatically display the current mortgage interest rates and how they’ve changed over time.

This sort of information is immediately useful and usable, and it may even provide you a leg up on the process by helping you secure a lower interest rate when you’re ready to buy. It’s true that your decision to purchase will depend on a huge host of factors in addition to the mortgage rate. You’ll want to figure in the amount of the down payment, the overall cost of the property and the factor of affordability so you can make a smart choice. But if you can’t comfortably pay your monthly mortgage, struggle and stress will most likely find you. And that’s why this app is so handy.

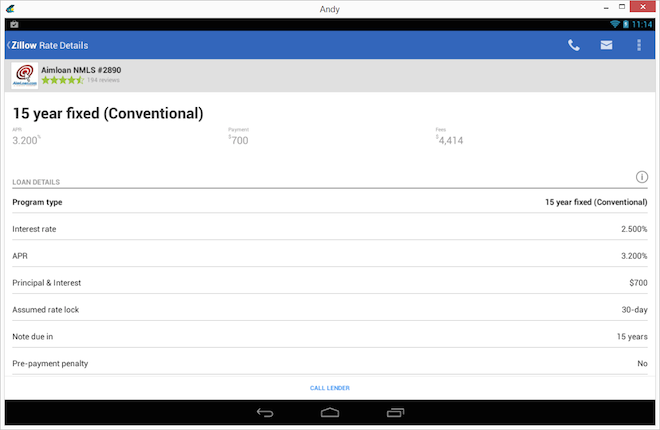

Zillow Mortgage Calculator will help provide a better picture of affordability. You can use the app to enter basic items like zip code, cost, down payment and credit score. The calculator will then show you a list of available interest rates complete with links to the individual lenders offering these mortgages. You use these numbers to calculate your monthly mortgage, including the fee charged by the lender to process the loan.

This app can also help you explore more advanced details. You can input your annual income, monthly debts, veteran’s benefits etc. to help hone in on more detailed search results.

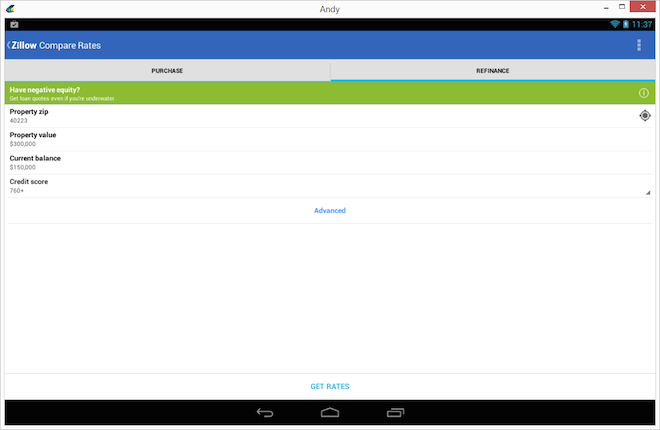

Zillow Mortgage Calculator can do more than just help you determine mortgage rates for a new home. It can also help current homeowners assess their refinancing options. Getting a lower interest rate for the remaining principal on your current mortgage might save you large amounts of money over the course of a mortgage loan.

Of course, after the real estate bubble burst in the US, many homeowners found they were underwater. That is, they owed more money than their house was worth. That is a more complicated situation but, even in this case, the Zillow Mortgage Calculator is handy. You can use it to help you gain some perspective on this uncomfortable situation.

Bottom Line

The Zillow Mortgage Calculator is truly designed for those seriously looking to buy a house. If you’re not quite there, you might want to use a more conventional mortgage calculator that simply estimates your monthly payments.

Because Zillow’s app puts you in contact with lenders who will initiate the purchase process, you’ll want to use it when you’re ready to make the call.

Happy hunting!

The Zillow Mortgage Calculator is available free for Android on Google Play, Apple iOS and even via browser.

For aNewDomain, I’m Mark Kaelin.

Ed: The original version of this review ran on aNewDomain’s BreakingModern. Read it here.

Featured image: Numbers and Finance by reynermedia via Flickr

All screenshots: Mark Kaelin for aNewDomain, BreakingModern. All Rights Reserved. 2015.