aNewDomain.net — The book Flash Boys: A Wall Street Revolt, written by Michael Lewis, is a fresh take on high-frequency trading and traders. Lewis delves into the concept of gaining an advantage based on milliseconds of trading — essentially algorithms and computers quickly saving or making you money.

Lewis was interviewed by Terry Gross on Fresh Air, which you can listen to here, or read here.

In the interview, Lewis speaks about the complexities of computer trading today. He focuses on the issues of instability and how blazing-fast access coupled with trading algorithms can entail a huge advantage.

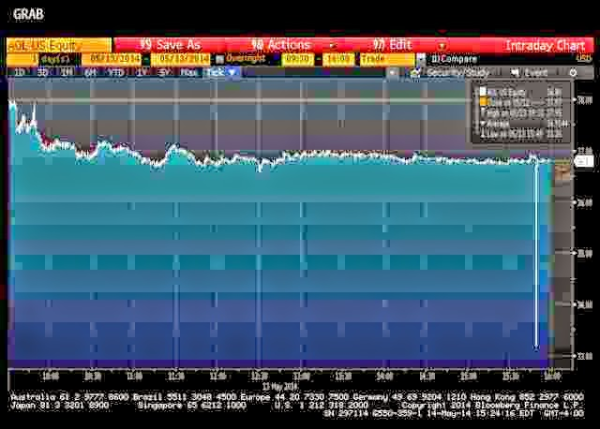

On May 14th a small example of Lewis’ concepts were illustrated. As Bloomberg columnist Matt Levine stated, the stock market went WOOSH for a second.

The image below is a bit fuzzy but you can get the picture. You could have made a great deal of money in one second, if, of course, you had a blazing-fast computer with a blazing-fast connection to a stock exchange.

Image credit: Larry Press

I personally cannot imagine the complexities of modern electronic trading markets. It does make me curious, however, if the transaction cost we pay per trade is actually indicative of something more dangerous.

Does it undermine the impartiality of capital markets? Will it foreshadow a feedback-driven disruption? I cannot find a societal value that justifies the time and money being invested to achieve high-frequency trading.

For aNewDomain.net, I’m Larry Press.

Based in Los Angeles, Larry Press is a founding senior editor covering tech here ataNewDomain.net. He’s also a professor of information systems at California State University at Dominguez Hills. Check his Google+ profile — he’s at +Larry Press — or email him at Larry@aNewDomain.net.