Dear Mr. President,

As a columnist here at aNewDomain.net — and as the intellectual property attorney who first coined the term “patent privateering” and published evidence in 2007 that mega mass patent aggregator Intellectual Ventures routinely buys, sells and litigates patents via thousands of oddly-named shell companies under veil — your Google+ February 14 State of the Union fireside comments on patent trolls intrigued me.

(Ed note: Find President Obama’s video — and many of the documents to which it refers — below the fold. April 5 update: Google added its comments to the DOJ FTC site, calling such patent aggregators patent “privateers.” Find the post about the letter at the Google Public Policy blog and the DOJ comments it and other companies made on the last day of open comments for the FTC-DOJ look at patent trolls — here.)

In that February 14 hangout, you said patent “trolls don’t actually produce anything themselves … they just leverage and hijack somebody else’s idea and see if they can extort some money out of them.”

“Extort,” you said. “Hijack.” These are fighting words in my neck of the woods.

There are countless investors and inventors in Silicon Valley who are with you on those descriptions of so-called patent trolls. But as GigaOm rightly asked: Exactly what do you plan to do about it?

It sounds like you mean business. But do your investigators at the Department of Justice (DOJ), the Federal Trade Commission (FTC), the Securities and Exchange Commission and the Internal Revenue Service have the time, patience and gusto to examine the murky and incestuous mire that patent trolls have created to obscure their activities in the tech world?

The whole of U.S. tech innovation and its future is at stake here. And your investigators are going to need a road map to figure it all out.

Here’s a 12-point plan for you and your agencies to jumpstart your patent troll investigation project.

1. Don’t stop at anti-competitive issues. Tech insiders are well aware that the DOJ, FTC and the United States Patent and Trademark Office are moving to investigate firms like IV and whether they’re violating antitrust and anti-competition laws. But that’s just a start. To truly figure out what’s going on here, you need to go further — a lot further — than just looking at antitrust and anti-competition. And you need all the subpoena firepower these agencies bring to the table to really figure out what’s going on here.

Only the feds have the tools to figure out whether patent “trolls” of such massive size are defrauding investors, slowing tech innovation, violating tax laws, and perhaps even extorting companies to invest their patents and dollars in exchange for IP litigation and injunction protection.

Sunshine is a good thing, as my co-author, UC Hastings professor Robin Feldman, likes to say. Our article for The Stanford Technology Law Review — The Giants Among Us — is a good place to start. When you read that, you’ll understand the enormous lengths mass aggregators have gone to in order to conceal their activities from the governments, universities, inventors and huge tech firms that either invest in or do business with them.

Consider whether patent assertion entities, as the FTC calls them, as a whole and individually are violating racketeering statutes under RICO — or if they are mischaracterizing their investment and litigation profits and the taxes they pay.

Are they getting tech companies to back them willingly or coercing them to do so? Getting to the truth of the matter has to be a multi-agency effort.

Demand that your U.S. agencies develop a full and complete picture of Intellectual Ventures at the very least. No private party could adequately conduct such an investigation. Only the federal government has the resources for this task. Every party who has ever dealt with IV is under the strictest, most-draconian non-disclosure agreement possible.

Your guys could plow through that and tell the world what’s really going on.

Tech has never needed more sunshine than it does now. Just look at IV. Led by former Microsoft CTO Nathan Myhrvold, ex Intel IP chief Peter Detkin, Seattle attorney Greg Gorder and ex MS exec Ed Jung, IV quietly grew over 10 years to assume now-massive proportions. It appears to be the nation’s single largest patent holder — and is involved directly or indirectly in hundreds of tech patent lawsuits that waste tech company money, which would otherwise funnel into R&D to develop new American products for the global marketplace.

There are suits where defendants often can’t even tell IV is involved. And tech buyers hear one thing and discover another.

For instance, it took a court order just to find out that tech companies like Microsoft, Nokia, Apple and Sony are among those who fund Intellectual Ventures in exchange for rights to its patents and other perks. As for Apple, this is a company that has testified before Congress about the damage patent trolls do. Yet it backs one. What is going on?

2. Think outside the box and examine how U.S. and foreign research labs have sold or exclusively licensed valuable intellectual property to IV and other patent mass aggregators. No one will know the extent of it until your investigators get the secret agreements.

Your agents will be able to find out under what conditions the fruits of government-owned and taxpayer-funded research went to aggregators who have no intention to ever make actual products. These are patent trolls, as you called them.

Suggestion: Examine the government’s transactions with limited liability companies having names such as: Vytral Systems Co. Ltd, LLC, Elemental Wireless, LLC and the Doar, Pekuin, Sall Limited Liability Company. These are quite possibly alter egos of patent trolls.

And consider alerting your counterparts in the Canadian, British, German and French governments about this. Their research agencies have likewise sold or exclusively licensed patents to patent aggregators operating in the U.S. either directly or indirectly via shell companies that don’t appear to be connected to big patent trolls — unless you do a deep dive.

These countries should know how the legal rights to publicly funded research ended up in private hands in the United States.

For example, here’s proof that the British government sold patents to Intellectual Ventures by way of its Intellectual Ventures Fund 20 LLC. I imagine Her Majesty the Queen, as listed in the transfer doc, would also not be pleased that patents went to another IV entity, a shell company with a comical German name. Here’s proof of that.

3. Make sure your investigators know that U.S. universities have sold or exclusively licensed patents on research funded by federal grants to Intellectual Ventures and other patent mass aggregators. Caltech, for instance, actually granted exclusive licenses of its IP to Intellectual Ventures Holding 59 LLC. That was in 2009.

Consider U.S. patent 7,023,435, which Caltech licensed to that IV-related LLC. Called “Object surface representation and related methods and systems.” The ‘435 patent even includes a government interest statement that reads in part:

The U.S. Government has certain rights in this invention pursuant to Grant Numbers ACI-9721349 and DMS-9874082 awarded by the National Science Foundation.”

IV has publicly admitted it does business with more than 300 universities worldwide, but most of these transactions aren’t publicly visible because they are exclusive licenses that don’t have to be publicly recorded.

Ask whether current federal regulations prohibit the sale of government-sponsored research to the companies you call “trolls.” When the results of government-funded research IP goes to patent aggregators who never will make actual products, I pause.

You should, too, Mr. President.

4. Have your investigators look into the extent under which it is acceptable under U.S. competition laws for companies to use a patent aggregator as an alter ego to compete against other companies. This is what I call privateering and it happens more frequently than you might know.

Apple is yet again a good example of this phenomenon. Patent records show that Apple sold 12 patents — via a company named Cliff Island — to Digitude Innovations, once a Virginia-based patent aggregator that had as its major stakeholder NYC venture firm Altitude Capital Partners. Two of the 12 patents that Apple transferred — patent Nos. 6,208,879 and 6,456,841 — formed half the basis of Digitude’s February 2012 lawsuit (PDF) against Motorola Mobility Holdings, a division of Google.

This lawsuit dried up when another patent aggregator, RPX, purchased Digitude and the Apple patents along with it. But you can find the background in the U.S. Patent and Trademark Office (USPTO) patent-assignment database.

Should companies rightly use their membership in patent aggregator funds as a means of accomplishing ends that would be impossible on their own?

Why didn’t Apple just sue Google directly, you might ask?

Here’s a list of tech companies that have sunk money into Intellectual Ventures, below. According to public docs, investments are in the cumulative billions. Verizon alone paid more than $350 million into IV, according to an SEC doc Verizon filed in 2008 that references the $350 million figure.

An excerpt from Verizon’s 2008 SEC filing:

During 2008, we entered into an agreement to acquire a non-exclusive license [IP License] to a portfolio of intellectual property owned by an entity formed for the purpose of acquiring and licensing intellectual property. We paid an initial fee of over $100 million for the IP license, which is included in [other] intangible assets and is being amortized over the expected useful lives of the licensed IP.”

Additionally, the SEC filing said, Verizon invested $250 million “to become a member in a limited liability company” that gives Verizon rights to “certain intellectual property” in return for a license fee Verizon must pay annually.

Tech investors in Intellectual Ventures

|

Investor name |

Which IV fund |

|

Adobe Systems Inc. |

Invention Investment Fund II |

|

Amazon.com NV Investment Holdings Inc. |

Invention Investment Fund I, II |

|

Apple Inc. |

Invention Investment Fund I, II; Intellectual Ventures II |

|

Cisco Systems Inc. |

Invention Investment Fund II; Intellectual Ventures II |

|

eBay Inc. |

Invention Investment Fund I, II |

|

Google Inc. |

Invention Investment Fund I |

|

Intel Corp. |

Invention Investment Fund I, II |

|

Microsoft Corp. |

Invention Investment Fund I, II; Intellectual Ventures I, II |

|

Nokia Corp. |

Invention Investment Fund I, II; Intellectual Ventures I, II |

|

Nvidia International Holdings, Inc. |

Invention Investment Fund I, II |

|

SAP America Inc. |

Invention Investment Fund I, II |

|

Sony Corp. |

Invention Investment Fund I, II; Intellectual Ventures I, II |

|

Verizon Corporate Services Group, Inc. |

Invention Investment Fund II; Intellectual Ventures II |

|

Xilinx Inc. |

Invention Investment Fund I, II |

|

Yahoo Inc, |

Invention Investment Fund I, II |

Source: Lawsuit filed on May 16, 2011: Xilinx vs Intellectual Ventures

5. To what extent are the patent aggregators separate entities at all? Most do business with one another — they only compete for patent assets, and that nobody can deny.

Consider the extent to which Mosaid, Wi-Lan, Transpacific IP, the Rockstar Consortium, and Round Rock Research are genuinely independent parties. Might they possibly be different faces of the same overall entity? This matters for a lot of reasons. Check out a letter penned by a group of antitrust lawyers who claim that Rockstar (Microsoft, Apple and other firms) promised the goverment one thing before purchasing 4,000 Nortel patents for $1B but then delivered quite another. That letter is embedded below.

6. Have the fundraising activities of the patent mass aggregators satisfied the legal requirements for the SEC and the various states in which the patent trolls operate?

Consider: A guy named Andre Lee was listed in Intellectual Venture’s fund raising documents filed with the SEC in 2007 as a “promoter” for its Invention Development Fund I — a billion-dollar fund he later apparently ran as an Intellectual Ventures employee. Yes, that’s the same Andre Lee who is widely reviled for almost single-handedly bringing down one of Asia’s most prominent investment banks, Peregrine, in 1998.

According to a judgment, a Hong Kong Judge in 2009 disqualified Lee from being a director of a Hong Kong company for four and a half years. That disqualification order was made as part of proceedings that started way before he joined IV — circa 2002 by Peregrine’s official receiver.

What sort of disclosures did IV make to investors in the Invention Development Fund about Andre Lee and the then-pending investigation against Lee in Hong Kong?

7. How does a company like Intellectual Ventures handle its taxes? After all, the company comprises a web of at least 1200 limited liability shell companies. Some of these companies own patents. Some own exclusive licenses. Others control specific investments and some handle only licensing or litigation matters.

Does each entity file a tax return or does IV somehow homogenize profits and losses across all these companies? Is one set of companies responsible for the debts with another set of companies set up as responsible for the revenue? How does it work? It sounds complicated and makes for some tricky tax issues at the very least. Perhaps the IRS should look into that.

8. Here’s another question for you: Have companies, governments and inventors — particularly sole inventors — received remuneration from IV after they sold or licensed patents to it?

Has IV ever assessed them with unforeseen charges? Has IV satisfied the expectations of The American Inventors Protection Act (AIPA)?

9. Should commitments made by one set of patent owners be binding — that is, operate as a covenant — for future owners of the patent?

As I mentioned above, it seems like the commitments made by Microsoft and Apple to the DOJ during the approval of the Nortel acquisition should be binding on the portfolio’s future owners, e.g., Rockstar IP.

10. How does the internal management structure work for complex and shadowy patent mass aggregators like IV? Do these companies disclose the management structure to their investors — and how do they make decisions?

After all, Intellectual Ventures sued its investor Xilinx and various Android smartphone manufacturers who were business partners with IV investor Google. What is up with that?

11. Does the patent licensing system in the U.S. favor a licensor’s aggression over the merits of the underlying patents? It sure looks that way.

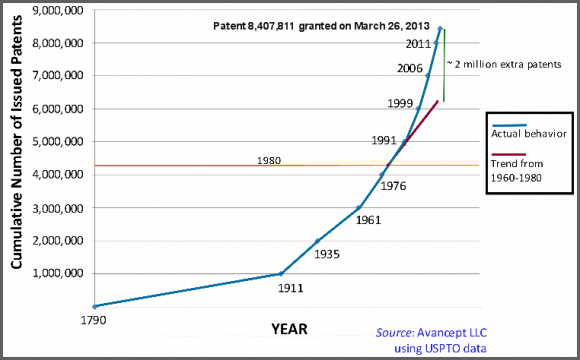

12. Is the patent licensing market impaired by the tremendous growth in the number of patents during the past 20 years?

Look at my chart below. If the patent allowance rate of the 1963 to 1980 era had stayed in effect through the pro-patent era that began in 1980, there would be 2 million fewer issued patents today. That means we would have 6 million U.S. patents as opposed to the current 8 million plus.

The U.S. Patent Office issued its first patent in 1790. Patents issue sequentially. The most-recently issued patent was 8,407,811. The halfway point for US patents was 4,203,905 which was issued on May 20, 1980. So, half of all granted U.S. patents were issued after May 20, 1980 – 190 years of R&D on one side of the midpoint line and 33 years on the other.

Of course, some of this growth resulted from heightened R&D funding. But much of it traces to companies simply filing for patents more often. That means more opportunities for tech litigation and trolling. As you know, Mr. President, the United States has the world’s most-expensive and complicated infrastructure around patent litigation. That’s got to be changed. But to change it, you need to identify the heart of the problem.

Image Credit: Tom Ewing for avancept.com

Thank you for your continued interest in the U.S. innovation system and the legal rights and responsibilities related to it.

Sincerely yours,

Here’s the video from President Barack Obama and his Google+ State of the Union Hangout, where he said, “patent trolls … extort” and “hijack” tech innovations. The comment is at 16:47.

Video of U.S. President Barack Obama on Google+ Hangout: Via TheDailyConversation Youtube Channel

Here’s what the American Antitrust Association wrote to the government regarding antitrust issues and patent trolls. It names Intellectual Ventures and notes the issues with Rockstar and its failure to keep to government agreements.

American Antitrust Institute on IV; by Gina Smith

Here’s the full transcript from a recent USPTO hearing on transparency issues as they pertain to the patent business.

USPTO Seeks Patent Troll Transparency full transcript by Gina Smith

Here are the comments that UC Hastings prof made to the DOJ. It is one of more than a dozen comments the DOJ posted by its April 5, 2012 deadline in its look at patent assertion entities.

Robin Feldman DOJ FTC Patent Troll investigation comments by Gina Smith

Here’s an article, it features Robin Feldman and me, on the topic of patent privateering. I coined the term patent privateering quite awhile ago, but it’s only now in vogue.

On Patent Trolls: PA Governor interview with Tom Ewing, Robin Feldman, IP experts by Gina Smith

Here’s a letter, also in the public comments area on the DOJ/FTC area, from persons representing Iowa startups re transparency and “bad actor” patent trolls.

Iowa Startup Comments to DOJ on Patent Trolls

Here is the official comment Barnes&Noble exec provided the DOJ-FTC. Find all the public comments here.

Barnes & Noble to DOJ On Patent Trolls

Tom Ewing is an internationally-known intellectual patent attorney who advises the World International Property Organization (WIPO) on patent issues. He’s also a senior editor at aNewDomain.net.

Such a deep dive, Tom. Very interesting stuff here.

-RAP, II

Wow. The ultimate compendium. Great work anewdomain

[…] We’ve been following New York’s investigations into the matter. In Dear Mr. President, I personally appealed to U.S. President Barack Obama to look deeply into the … […]

[…] Ed: This is part of our continuing series that looks at whether Intellectual Ventures and other patent assertion entities (PAEs) are indeed anti-competitive as some officials at the FTC and DOJ suggest. Check out Tom Ewing’s Dear Mr. President piece regarding patent trolls here. […]

[…] So who is Personal Audio LLC? And does it really, as so many fear, hold a fundamental patent that affects all podcasters everywhere? Certainly, it has the Electronic Frontier Foundation up in arms. Check out Tom Ewing’s appeal to U.S. President Barack Obama regarding the Department of Justic… […]