aNewDomain — Greece has fewer than two weeks to make peace with its creditors. Otherwise, it will default on existing loans. A so-called “grexit” from the Eurozone could pound European stocks and the Euro, leading to a period of global financial uncertainty that, of course, can impact U.S. stocks and the value of the dollar.

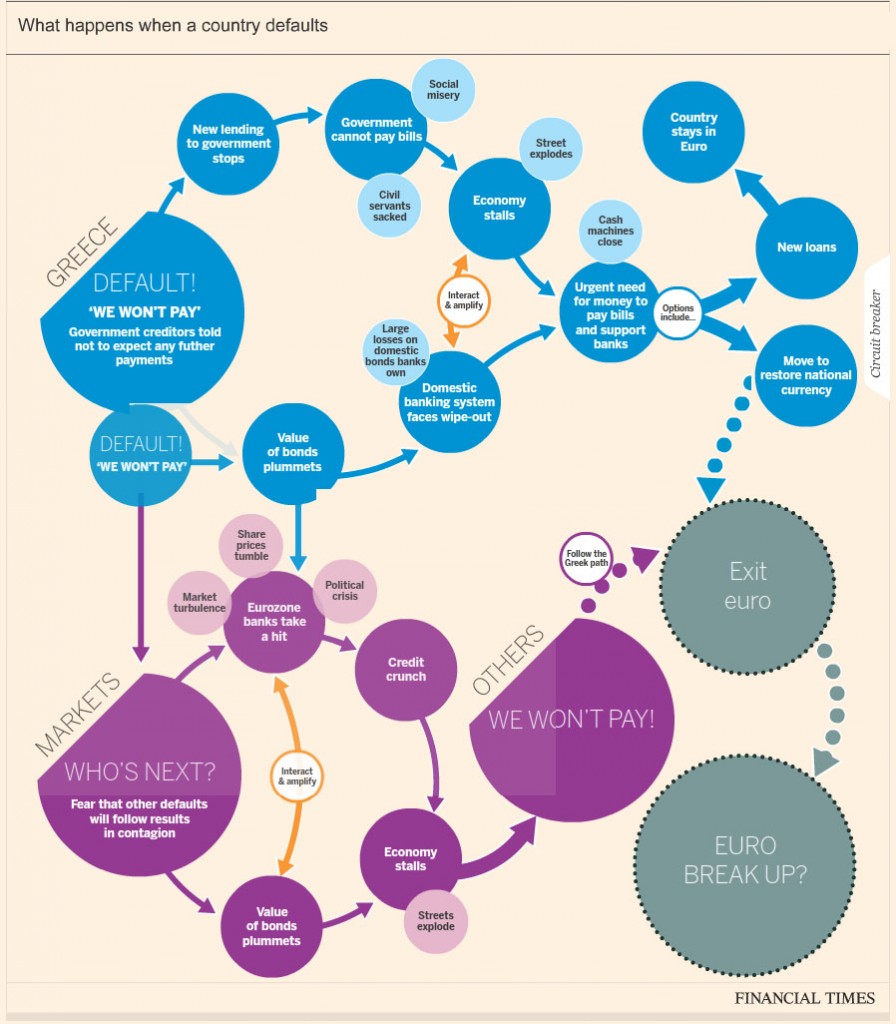

European leaders have scheduled an emergency meeting on Monday in hopes of beginning to resolve the problem. A meeting of European finance ministers on Thursday failed to make any headway in solving the looming crisis. What happens when a country can’t pay its debts? Check out the infographic below, and scroll down to understand more about Greece’s role in the European sovereign debt crisis.

What Happens When A Country Defaults infographic: the Financial Times and Lombard Street Research, via Visual.ly

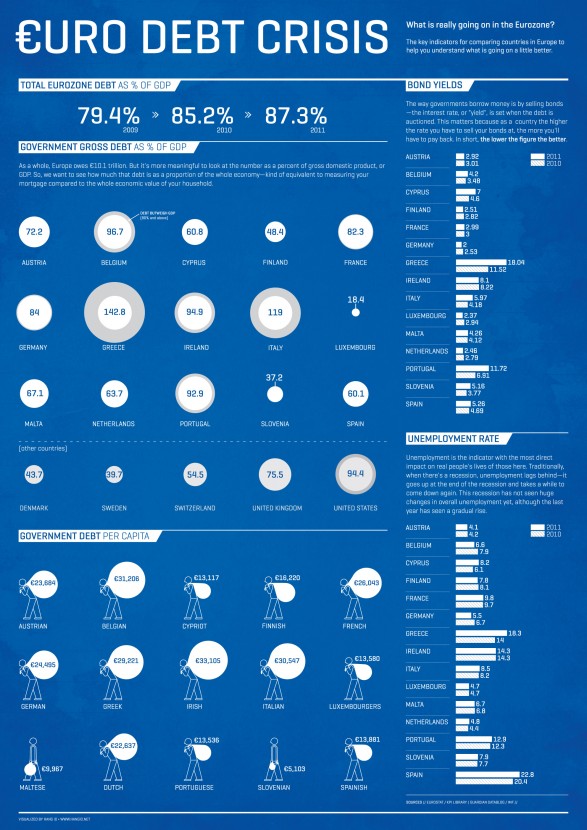

Understanding how Greece got in this position is a little more complicated than just saying that the country’s government spent more than it took in. Here’s a primer from when the crisis began a few years ago that will help you get to the bottom of it.

Euro Debt infographic: via HangIO and Visual.li

For aNewDomain, I’m Tom Ewing.

Cover image: Jean-Antoine-Théodore Giroust, Oedipus at Colonus, 1788, Dallas Museum of Art