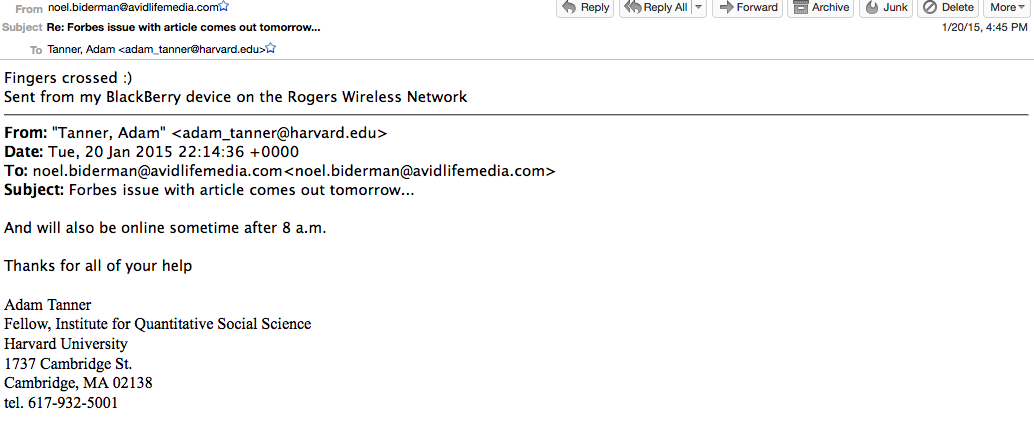

aNewDomain — Back in January, Avid Life Media CEO Noel Biderman asked his COO where the data came from in an AshleyMadison.com summary deck his firm was about to send Forbes reporter Adam Tanner for his ongoing investigation of the company.

— Back in January, Avid Life Media CEO Noel Biderman asked his COO where the data came from in an AshleyMadison.com summary deck his firm was about to send Forbes reporter Adam Tanner for his ongoing investigation of the company.

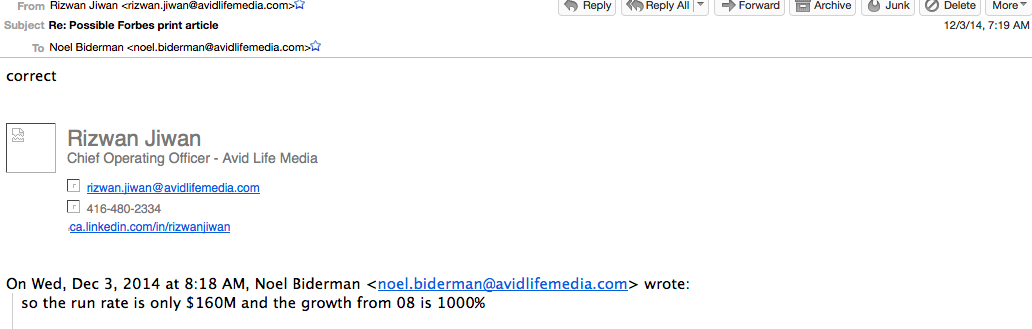

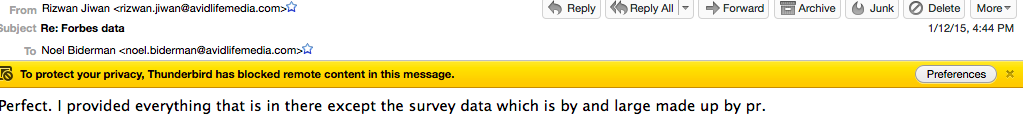

The numbers were his, COO Rizwan Jiwan told Biderman, with one exception:

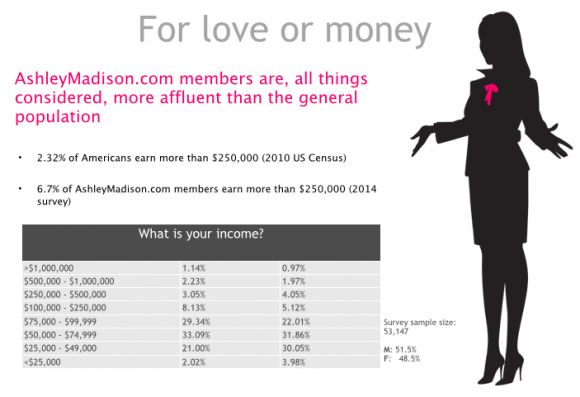

The survey data describing Ashley Madison members, the female ones in particular, was “by and large made up by PR.”

Here’s one of the some 200K emails leaked in the Ashley Madison hack this summer.

This continuing series aims to explain how and why hundreds of respected media outlets all over the world have falsely portrayed AshleyMadison.com so many times over the years, as leaked emails suggest.

From 2010 right up to now, reporters have characterized Avid as a “billion dollar company” (it isn’t), that was starting talks for an IPO in London (it wasn’t) and always busily surveying “adulterers” to find out their favorite bars and restaurants in various cities (nope).

Still other media outlets characterized Avid’s revenue streams as coming solely from AshleyMadison, CougarLife and EstablishedMen “dating” sites (untrue), with 30 million or even 40 million members (untrue). Still more have characterized AshleyMadison.com and its sister sites as not adult oriented (untrue) and that near-equal numbers of (actual) women as men signed up for the sites (no again).

A combination of creative PR, lots of imagination and an army of journalists who routinely accepted everything Avid handed them at face value without third-party perspective or confirmation were mostly responsible for all this disinformation.

A combination of creative PR, lots of imagination and an army of journalists who routinely accepted everything Avid handed them at face value without third-party perspective or confirmation were mostly responsible for all this disinformation.

What leaked emails suggest to us now, after two months of examination by this publication and others online, is a starkly different picture than what the media has largely portrayed.

How did so many mainstream, top-tier media get so much wrong about Avid so many times over the years?

The fault seems to truly lie with what some call today’s new journalism, a rapid-fire affair that emphasizes clickability and hits more than third-party confirmation, analysis or other long-used investigative techniques.

In an attempt to figure out where journalists went so wrong so many times about the facts around Avid and Ashley Madison’s success, last week we traced how Avid tried, but failed, to set up an ABC Nightline producer with fake survey data on female members and fake members to interview, members who turned out to be Avid spokespeople and outside consultants.

This installment looks into how Avid misled Forbes, Bloomberg and other big media worldwide about various aspects of its business over the years, which in turn led to a wholesale misinterpration by the media as to how valuable Ashley Madison really was and what the nature of Avid’s business really was.

Forbes: “In hindsight, (Ashley Madison stats) should have raised alarm bells.”

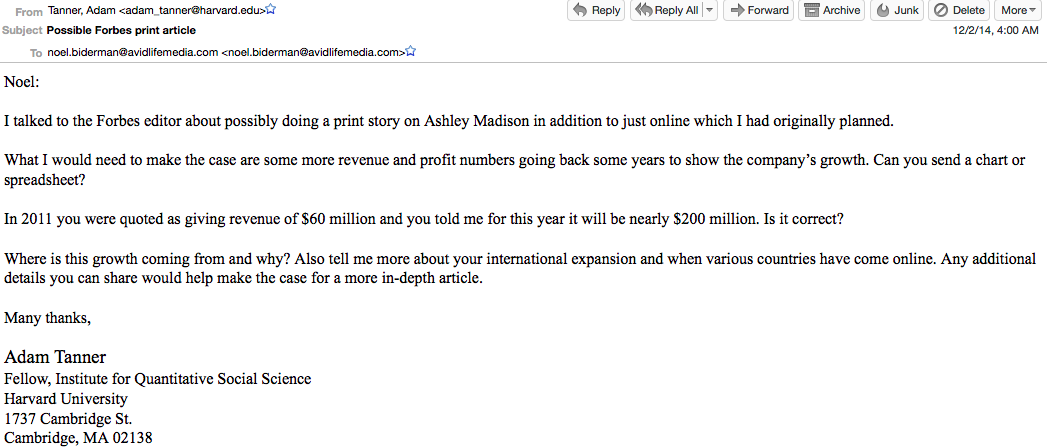

In January 2015, freelance writer and sociologist Adam Tanner published a glowing portrayal of Ashley Madison in “Even In The Tinder Era, Adultery Site Ashley Madison Keeps Making Money Hand Over Fist,”

In the article, Tanner portrayed Avid and Ashley Madison as growing rapidly — and, with a value he said was approaching $1B (that’s half the size of the whole digital dating market) and had grown nearly 1000 percent in just the last few years.

In that piece, Tanner wrote:

Tax documents and figures shared by Biderman showed that Avid Life Media grossed $115 million for 2014, up 45% from the $78 million it grossed in 2013, and up nearly threefold since 2010. Pretax profits, says Biderman, will come in at $55 million, which financial analysts say is a typical margin for the industry. Worldwide, the site has had 31 million total users over its lifetime, 6.8 million of whom logged in over the previous 90 days as of late November.”

![]()

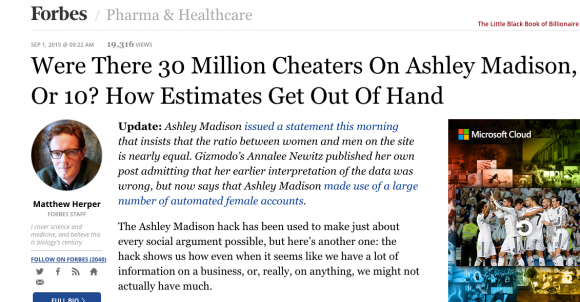

Last month, Forbes writer Matthew Herper backed away from the data in that earlier Forbes piece. As printed, Tanner’s claims about AshleyMadison.com’s size “meant that Avid was only grossing about $4 per customer if we believe the 30 million figure,” Herper wrote, adding that the figures Tanner printed “should have raised alarm bells.”

Herper wrote:

That meant that Avid was only grossing about $4 per customer if we believe the 30 million figure, even when the same story claims men spent $200 to $300 a year on the site. Which we really shouldn’t have. Is it really likely that one in four married American men are on a cheating website? In hindsight, that should have raised alarm bells. Even the figure of 6.8 million being logged in over the course of three months seems like it should be cause for skepticism. That’s pretty close to my guess of the site’s total number of customers, ever! If we use the $200 figure, we would guess based on that disclosed gross that Ashley Madison had about half a million users.”

Judging from the leaked emails allegedly sent to and from Biderman and now widely available due to the hack, Herper seems to have been on the right track with his guesses.

According to our read of actual Avid income statements that the company sent investors, the numbers Avid sent to Tanner were based on real statements that included Ashley Madison numbers but also numbers from all of its many other sites, as well as the significant income it derives from its huge affiliate network of adult-oriented escort listings.

To back up the numbers it gave to Forbes, leaked emails suggest, execs simply used all the revenues from all of Avid’s affiliate network, escort listings, content creation and upsells from the various dating si tes all over the world. And they attributed it all to just AshleyMadison.com.

tes all over the world. And they attributed it all to just AshleyMadison.com.

Avid, we see now from internal company docs, derived about 55 million in revenue from AshleyMadison.com in 2014 for its U.S. and Canadian sites. The firm’s total revenue, about $115M for 2014, came from its international activities, and the giant direct marketing network it runs through wholly owned Avid shell companies like Praecellens and Pernimus in Cyprus, emails suggest.

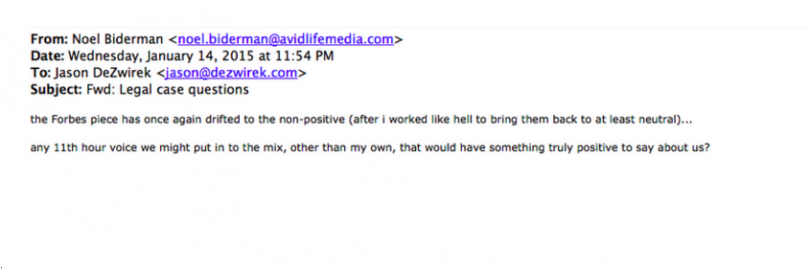

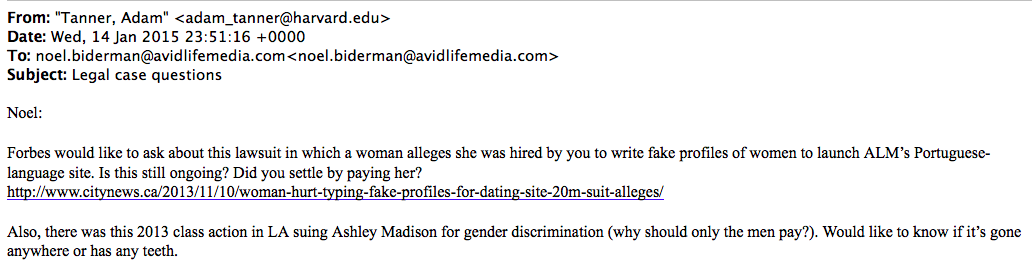

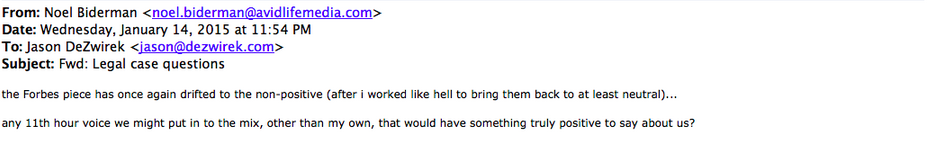

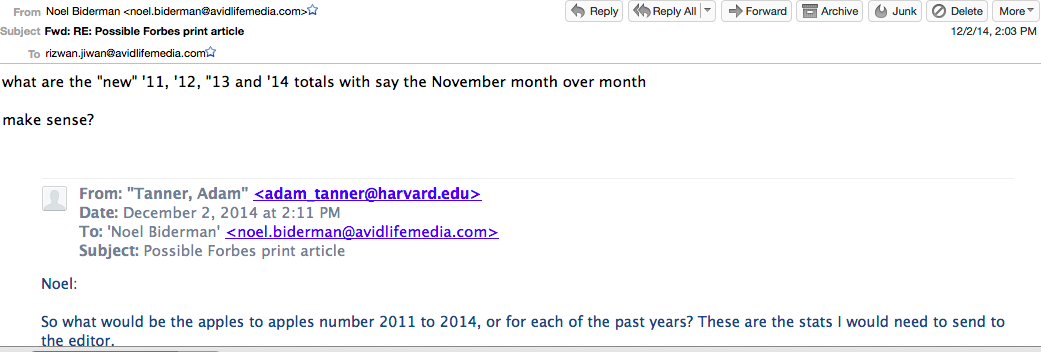

Of the 52 reporters whose email conversations with Avid we analyzed, Tanner and his editors were among the precious few to ask hard questions about Avid’s ongoing lawsuits and corporate structure, questions that appeared to worry CEO Biderman, who after one set of Forbes‘ questions told the firm’s largest investor, board member Jason DeZwirek, that he feared “the Forbes piece has once again drifted to the non-positive (after I worked like hell to bring them back to at least neutral) …”

Here’s the email that Biderman seems to have been responding to.

Biderman was right to worry, leaked emails suggest.

Biderman was right to worry, leaked emails suggest.

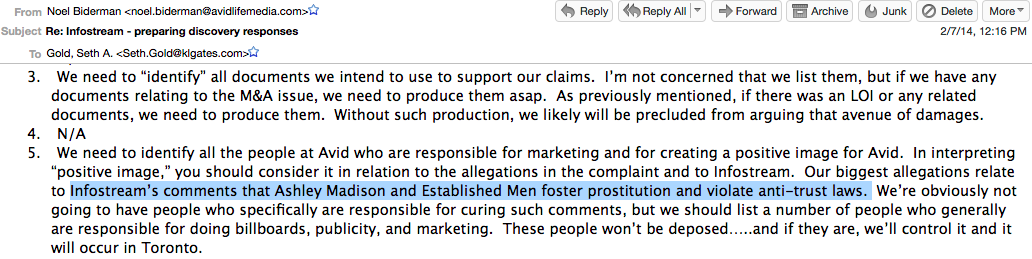

Tanner seems to have asked about the Infostream v Avid lawsuit, in which Infostream had also claimed that Avid truly was running not a dating site business but a network of affiliate escort service listings online.

Per the email below, there were “comments that Ashley Madison and (Avid site) Established Men foster prostitution and violate anti-trust laws.”

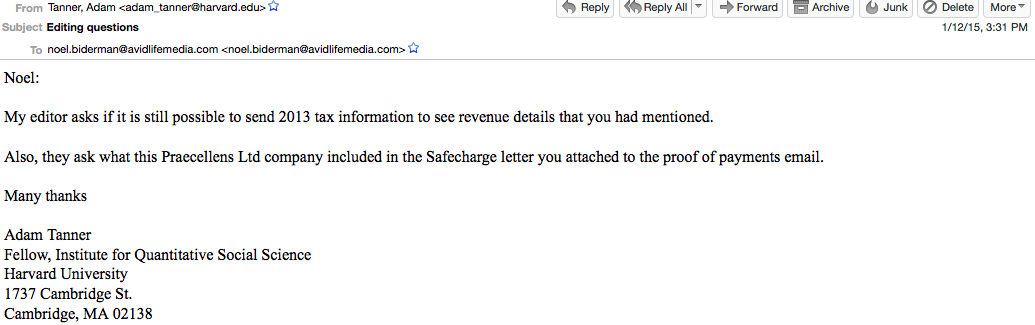

In another email, Tanner and his editor asked the 10 million dollar question — what is Praecellens?

Praecellens, based in Nicosia, Cypress, is the Cyprus-based Avid shell company that seems to do most of Avid’s billing and management, including billing for the firm’s lucrative adult-targeted direct marketing network, leaked emails suggest.

Like Pernimus, which this publication told you about two months ago, Praecellens is Avid, leaked emails suggest. Several other Avid shells exist, based in Canada, the U.S., the British Virgin Islands and Cyprus, as you see in the internal Avid chart I discovered on ScribD and confirmed last month. (Find it also, with other relevant documents used in this piece, below the fold …)

Figuring out that the financial data Avid had given it weren’t just for AshleyMadison.com but also for its other businesses in dating, online escort listings and affiliate marketing would’ve given Forbes a first clue that all was not as cut and dried as it seemed. AshleyMadison.com income from the U.S. and Canadian sites appears to contribute under a third of all revenues, judging from leaked emails.

Leaked emails do not reveal how Avid responded to Forbes about its Praecellens question, if ever, and neither Tanner nor his editor would comment for this piece on that or any other matter relating to its coverage of Avid and AshleyMadison.com.

What does seem clear from the leaked emails is the degree to which Avid execs had to go to convince Forbes that Ashley Madison was much, much bigger than it was. It seemed to have done this by using real revenue numbers for all the companies’ activities, including its lucrative direct marketing network, plus revenue from its many other “dating” sites and escort-listings sites all over the world.

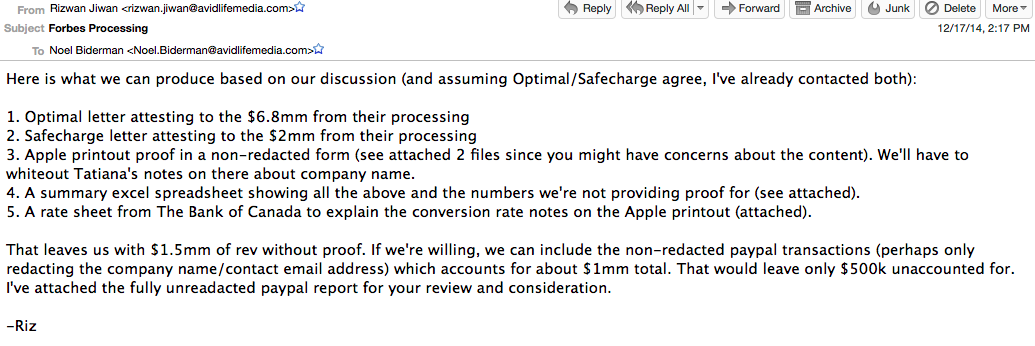

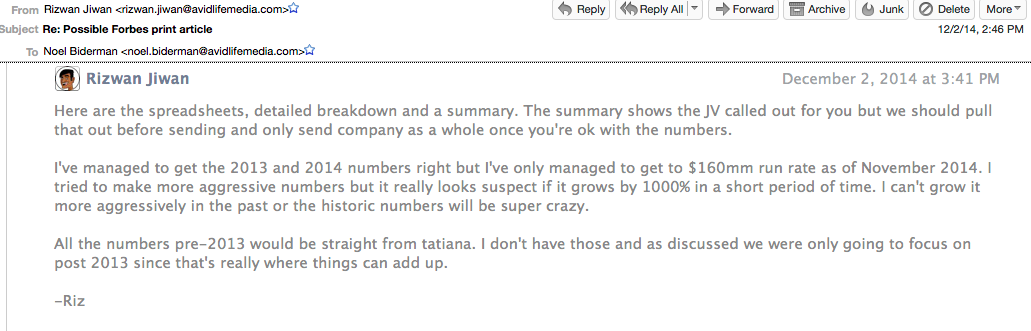

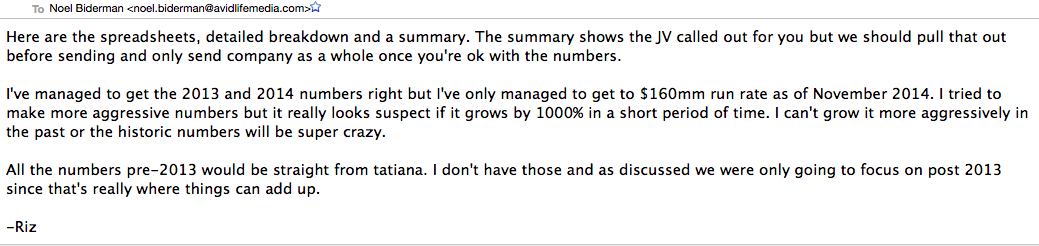

Here’s one leaked email from the cache, where the COO Jiwan tells Biderman he’s having trouble making the numbers look believable for Forbes.

The net effect of the final published piece in Forbes, though, was a big Avid win. Execs anticipated it …

In the final piece from Forbes and those of many others who followed suit, using the Avid-created “Forbes data” or just the Forbes article as their source, Avid after this became known as a $1B company whose success was mainly fueled by AshleyMadison.com. Even though that has never been the case.

After the piece ran, an all-employee email update went out from the firm’s production department, explaining what that division was going to do to maximize the so-called “Forbes PR.”

Forbes certainly went further in terms of investigating Avid before it published the Ashley Madison numbers than many other members of the media did over the years, the leaked emails show.

And in many ways, Forbes‘ Tanner and his editors seemed to have done everything, or almost everything, they could to prevent passing along false financial information to the readers who trust the publication. They asked for documentation — income statements, tax records and so on. How could they have known what they didn’t know — that the numbers were somewhat doctored to fit the story that the one AshleyMadison.com site was the one responsible for all that growth and revenue.

Once again, how could reporters look for something they didn’t even know was there? And from a private company at that?

They would have had to question Avid’s portrayal of such a large market and growth figures showing a 1000 percent improvement. Forbes‘ Herper, in the recent piece that said the data from the Tanner piece was “fishy,” arrived at that conclusion, but too late.

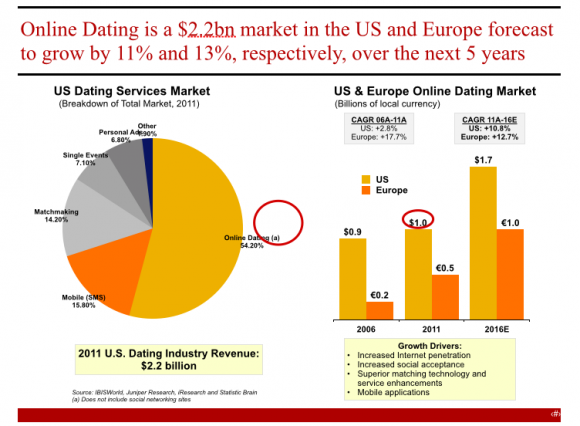

Forbes might also have talked to an industry analyst to understand how Avid could be valued as a $1B player in a digital dating market worth $2.2 billion.

In his Sept. 1 article backing away from the numbers Tanner published in the January 2015 Forbes piece, Matthew Herper wrote, “Add this to the lessons we learn from Ashley Madison: how to make something seem much bigger than it is, and how to realize when someone is doing so.”

A corollary: Don’t print any numbers from a private company without some kind of a caveat. A huge one, maybe in a text box, shaded. And in a colorful font.

Scroll below the fold to see some of the other background docs we used to report this story.

Bloomberg: Ashley Madison “is looking to raise as much as $200 million to exploit booming demand.”

The net effect of Forbes‘ memorialization of such exaggerated Ashley Madison growth and financials back in January made possible other stories that piggybacked upon its data.

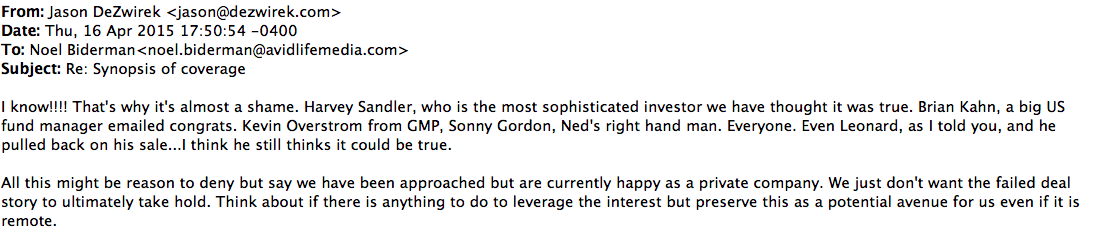

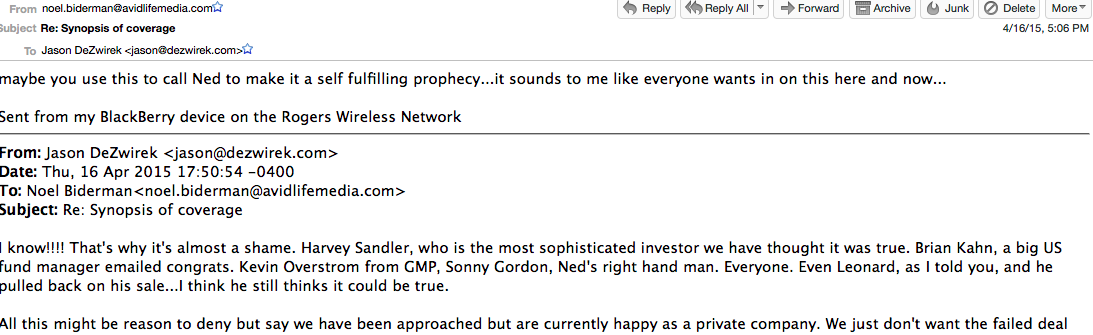

Take Bloomberg’s coverage of Avid and Ashley Madison in April 2015.

On April 15, a Bloomberg UK reporter ran with a story apparently fed to it by a European PR consultant from Avid, leaked emails show. When Bloomberg’s piece ran — it was titled “Adultery Website AshleyMadison Seeks IPO as Demand Booms” — it implied talks were underway for Avid to go public on the LSE to raise $200 million on a valuation of some $1B.

After it ran, Avid investor and board member Jason DeZwirek mused to Biderman that the piece sounded so believable, and the reception to the idea so warm, that the story should’ve been real.

Avid, we should note, had a failed IPO in Canada back in 2010, which the bank GMP Securities was a party to.

In Biderman’s response to DeZwirek, he wondered whether Avid could use the Bloomberg UK story “to make it a self fulfilling prophecy …”

Avid’s marketing chief later emailed Biderman about the net effect of media coverage that immediately followed in the first few hours after the Bloomberg fake IPO piece hit.

How much coverage was there?

According to a leaked email allegedly sent by Avid’s VP of communications Paul Keable to Biderman:

Eight print articles (including the Globe and Mail, the New York Post and La Presse), dozens of online articles, seven radio spots and some 22 TV pieces.”

The $1B valuation figure is of course consistent with the figure Forbes set out in January 2015, as we told you above.

Could the reporter have dug deeply and discovered that Avid in reality wasn’t worth $1B?

Could the reporter have dug deeply and discovered that Avid in reality wasn’t worth $1B?

He would have had to not trust the Avid PR guy who gave him the story, or he would have to question the information.

His editors, too, would’ve had to have supported him.

Still, journalism requires we don’t cover other journalists’ journalism, right?

You can see how misinformation snowballs.

At least Tanner does discuss the failed IPO Avid attempted in Toronto with GMP Securities, which as mentioned above, GMP reportedly backed out of. The 2010 deal apparently fell through after GMP learned what business Avid was really in.

Tanner might’ve called GMP Securities to see whether the bank thought Avid was worth anything close to the $1B figure or how an LSE IPO might be received. That might’ve been difficult, sources say, as a banker from GMP Securities appears to be or had been an Avid Life Media shareholder as recently as 2014.

And again, it’s been widely publicized that the whole of the digital dating business is worth about $2.2B. A slide with that widely-quoted market sizing can be found in the leaked Ashley Madison emails (above right), but it is also quoted all over the web.

But the publication seems not to have asked: Could Avid really be valued at nearly half its whole market?

Leaked emails, we should add, show that at least one company who discussed acquiring Avid valued it at about $100 million — for the whole business. That might have seemed like a low number to execs, but emails suggest that at least it was based on actual income and EBITDA figures. Read that Letter of Intent here. Another leaked email, find it below the fold, shows that Biderman told another investor the firm could be valued at nearly $200 million, according to the leaked emails.

As far as the so-called London IPO “idea” Avid floated out via Bloomberg? The BI ran a piece a few months later that announced it was “off,” something one marketing exec told top execs right after it ran.

Arizona Republic: The 2013 government shutdown caused “a spike in .gov email addresses” at AshleyMadison.com

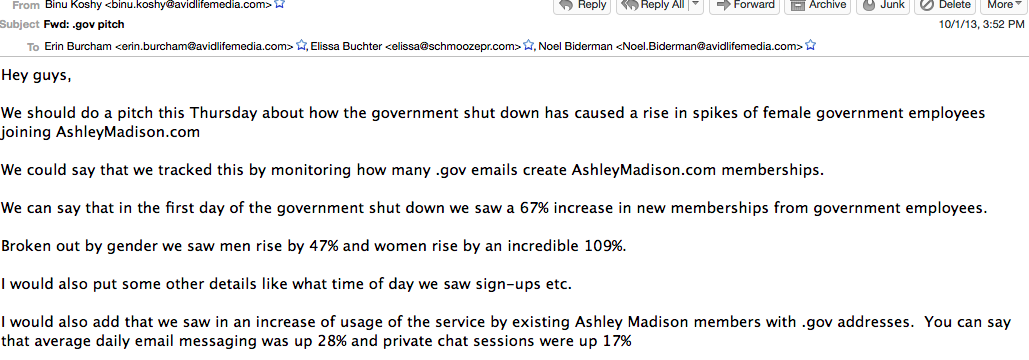

On October 1, 2013, Avid PR and marketing pros tried to think of ways to capitalize off of news of a U.S. government shutdown, leaked emails suggest …

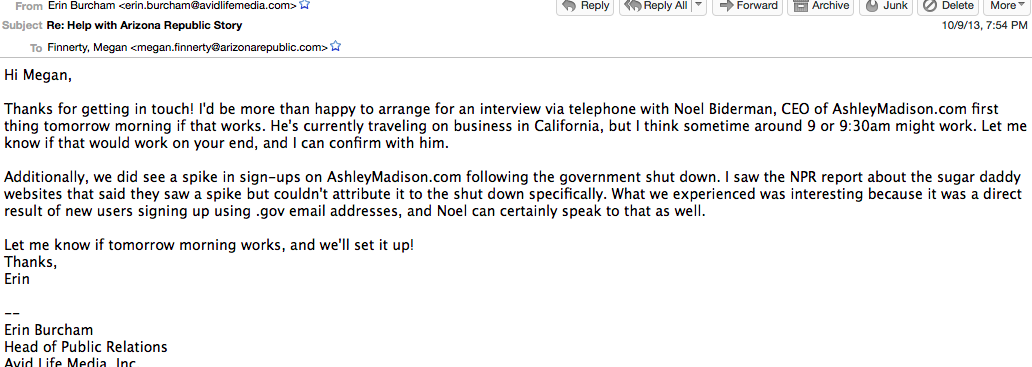

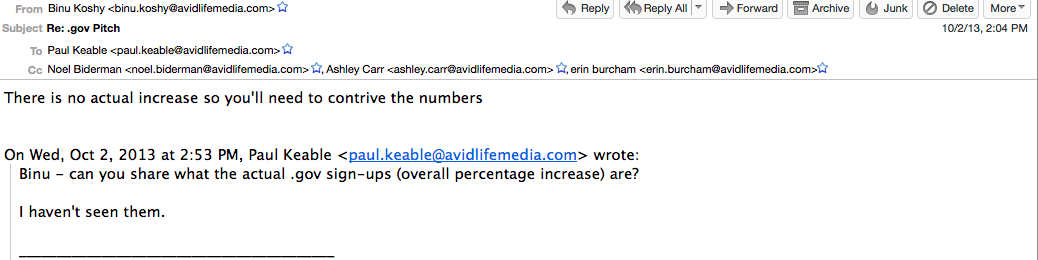

Here’s one of the leaked emails from the hack that suggests how one PR person was pitching a “spike in sign-ups on AshleyMadison.com following the goverment shutdown.” You can read a piece, based on this pitch, in the Arizona Republic here.

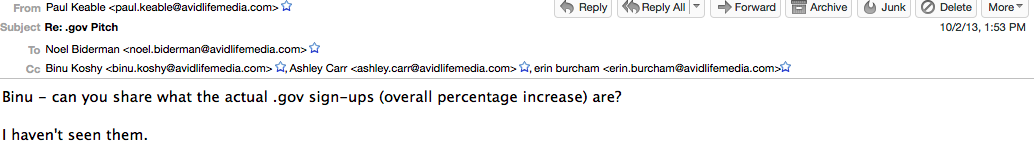

Only problem is, there was no spike. When asked about numbers that could support such a PR pitch, director of marketing Binu Koshy said “there is no actual increase … so you’ll need to contrive the numbers,” the leaked emails suggest.

That’s it for this installment of our investigation into the state of the media as reflected by the AshleyMadison.com hack and fall out. Our caveat: Avid executives did not respond to our calls for comment, and none of the 200K leaked AshleyMadison.com emails have been verified by the company or a third-party security company, with the exception of details released by the Toronto police in August 2015.

To be clear, Avid is a private company that breaks no laws by exaggerating or even fabricating anything about its business, our staff legal analysts say. But the fact that Avid has been able, since 2010, to so easily trick so many experienced, top-tier journalists so many times, as leaked emails and online searches show, should be deeply disturbing for anyone who cares about a free society, much less a free press.

After all, if an adult entertainment website has been able to outwit and totally misinform so many award-winning and respected journalists over the last five years so many times, how would they fare against well-heeled lobbyists, politicians and other leaders out to manipulate the public about key issues that could seriously harm them or society as a whole?

The discouraging answer right now is: Pretty poorly.

For aNewDomain, I’m Gina Smith.

Further reading:

Here is a PDF showing the structure of Avid Life Media and the names and functions of its various wholly-owned subs in Canada, the U.S., the British Virgin Islands and Cyprus.

Here are some of the leaked emails that shed light on the process Avid used to make its growth look more impressive and Ashley Madison’s numbers appear to be bigger.

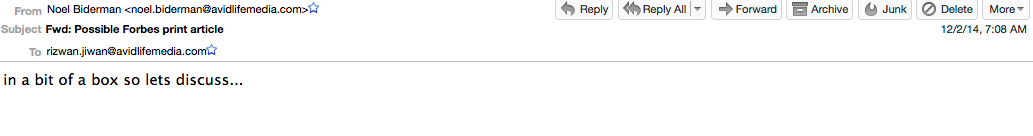

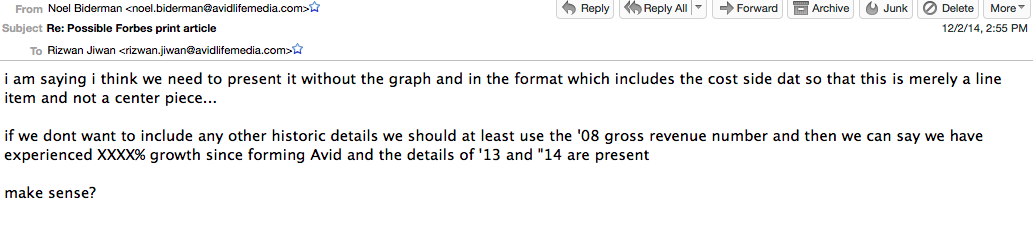

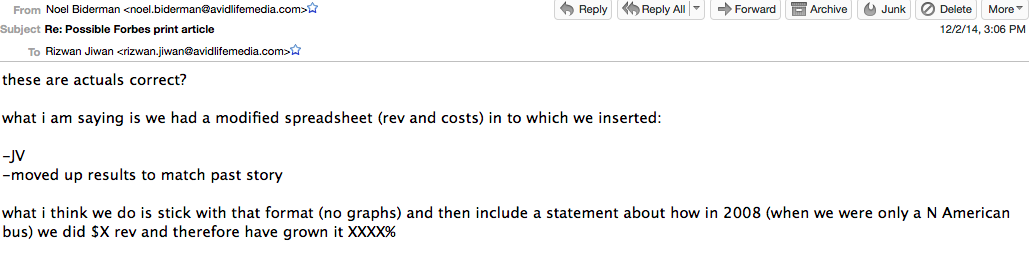

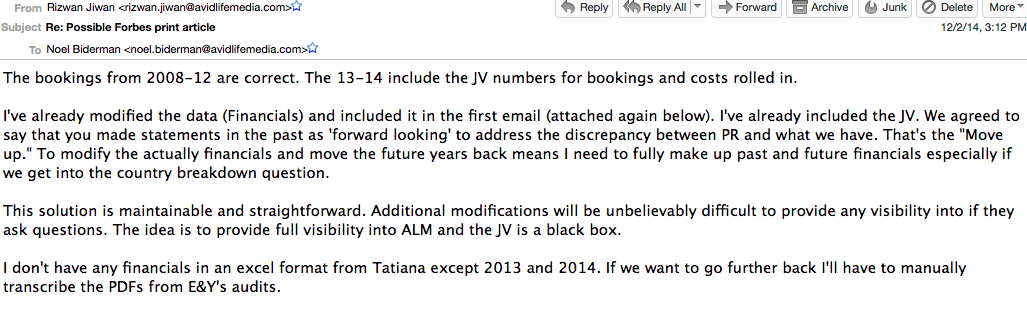

After Tanner sent his Dec. 2, 2015 message to Biderman, writing that he’d need income statements and other backup to “make a case” for a Forbes print article about Ashley Madison, Biderman sent COO Rizwan Jiwan the following:

Soon after, COO Jiwan sent Biderman this, according to the leaked emails allegedly sent to and from Biderman’s email box.

![]()