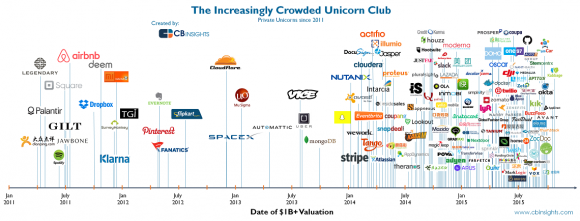

aNewDomain — Silicon Valley’s most venerable investors are now sounding the alarm that magical thinking about young, unprofitable companies has dangerously inflated a new tech bubble. Bill Gurley, whose firm, Benchmark Capital, which invested early in eBay, Twitter and Instagram, recently ventured a grim prediction: “I do think you’ll see some dead unicorns this year.”

A unicorn is a tech startup worth at least $1 billion.

“But the much ballyhooed cohort of highly valued private companies, the so-called unicorns, are heading for a fall every bit as dramatic as their hapless dot-com brethren 15 years before. The culprit will be exactly the same: their burn rates.”

There has been an explosion in unicorn creation, with over 60 new unicorns in 2015 alone. The “unicorn club” has become way less exclusive, and there are now currently 113 of them with a cumulative valuation above $400B.

E-commerce has the largest number of unicorns, with 25 companies in total, including E-commerce unicorns in foreign markets, like Meituan, Flipkart, and Lazada among others. Fintech and Internet Software & Services were ranked second with 14 unicorns each followed closely by Big Data (applications and infrastructure) which had 13.

All bubbles burst. The only question here is when.

For aNewDomain, I’m David Michaelis.

Image courtesy: CBS Insights