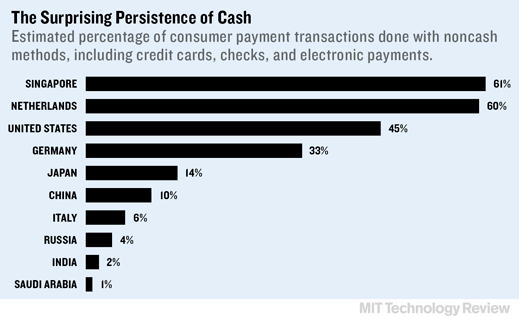

aNewDomain — In the bitcoin versus U.S. dollar versus credit card debate, the old greenback still reigns. Why?

According to MIT Technology Review, it all boils down to trust. With non-cash alternatives, there are a large number of security concerns. An Accenture survey of 4,000 consumers in North America revealed that fully 57 percent of respondents were concerned about the security of non-cash transactions, even though they said they expected to use other forms of payment this year and in the future.

57 percent? That’s up 12 percent from the survey results just two years ago.

Screenshot by David Michaelis courtesy of MIT Technology Review

Why is the belief in cash still more powerful than alternatives? It all has to do with control.

Blowing your Budget

The biggest disadvantage of credit cards is that they encourage people to spend money they don’t have. Most credit cards do not require you to pay off your balance each month, so even if you only have $100, you may be able to spend up to $500 or $1000 on your credit card. While this may seem like free money at the time, of course you will have to pay it off eventually. And the longer you wait, the more money you will owe, as credit card companies charge you interest each month on the money you have borrowed. No wonder so many millennials swear off credit cards. It seems so illogical, when you stop to think about it.

PayPal, Apple Pay and Google Wallet

A new way to look at the challenges is that tech will help with consumer confidence. PayPal, Apple Pay, Google Wallet and others utilize a system that creates a one-time digital token for each transaction and sends that token, rather than a customer’s credit card information, through the system. I am confident about these new technologies though there is not a clear path forward, and many across the world seem to agree with me.

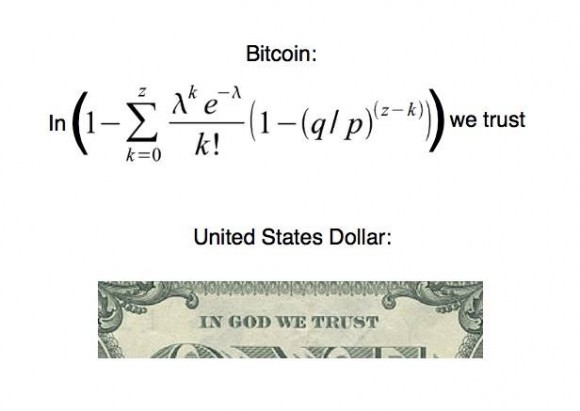

Screenshot by David Michaelis

In Brazil this past December, organizers of the Latin American Bitcoin Conference communicated their belief that no one can stop the increasingly rapid adoption of Bitcoin around the world, and that its use by individuals and corporations will soon be inevitable.

Reporting last year on the state of Bitcoin, Peter Smith of Blockchain.info and Susan Athey of Stanford University said that Bitcoin as a whole is here to stay, but that Mt. Gox may have shown us how not to handle Bitcoins.

What Mt. Gox does bring up is the historical difference on philosophy about how startups use the bitcoin protocol. There are two buckets – the first one is startups that centralize. When you send out bitcoins to Mt. Gox, they are moving that into a master account. Would I trust anyone with my bitcoins?

In the other bucket, you can find other companies, such as Blockchain, that provide software to more effectively and more securely manage your bitcoins. These bitcoin users manage their own public and private keys, meaning that you can’t break into a wallet if you don’t have the private key.

Screenshot by David Michaelis courtesy of Framasphère

As Lorin Chane Partain said on Facebook, “If the statement ‘In God We Trust’ were true, it wouldn’t be printed on central bank funny money.”

For aNewDomain, I’m David Michaelis.

Featured Image courtesy of Jonathan Waller, via Flickr Creative Commons