aNewDomain — No one ever heard of Bitcoin before a guy with a fake name uploaded a detailed paper about how the digital currency would work back in 2008.

— No one ever heard of Bitcoin before a guy with a fake name uploaded a detailed paper about how the digital currency would work back in 2008.

What a difference nine years make.

Now, Bitcoin’s pseudonymous creator, Satoshi Nakamoto, wasn’t the first to come forward with a digital currency. Previous digital cash tech included Adam Back’s HashCash, Nick Szabo’s bit gold and Wei Dai’s b-money.

But Nakamoto put digital currency on the map when he posted a now legendary white paper introducing Bitcoin and its working to a cryptography news list. That in turn led to the first Open Source bitcoin client software and the release of what’s now known as the Genesis Block, the first block of bitcoins ever.

A History of Bitcoin

In 2016, an Australian named Craig Wright came forward to claim that he was the mysterious creator of Bitcoin. He quickly changed his mind about proving it, though.

The proposed “system for electronic transactions without relying on trust” that was “robust in its unstructured simplicity,” as the Nakamoto paper describes it, sure was prescient.

[mks_button size=”large” title=”READ Telstar-1: How One Little Satellite Changed Everything” style=”rounded” url=”https://anewdomain.net/telstar-1-turns-55-how-it-changed-everything/” target=”_blank” bg_color=”#000000″ txt_color=”#FFFFFF” icon=”” icon_type=”” nofollow=”1″]

Unstructured simplicity is a good term to describe Bitcoin. But the history of Bitcoin is anything but. That’s why I’ve come up with the following list of 147 Bitcoin facts and developments. My list starts now and goes back to its very beginning — which also happens to be the beginning of the end for fiat currency.

Ready? Let’s go.

-

-

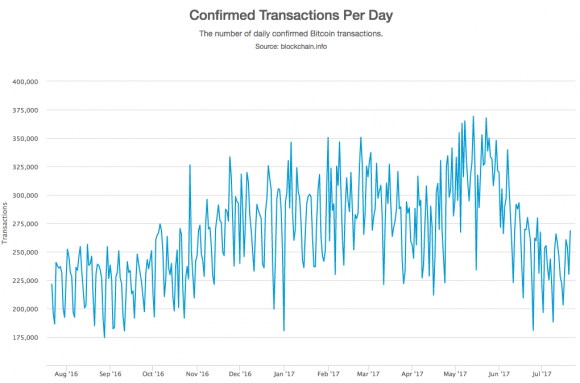

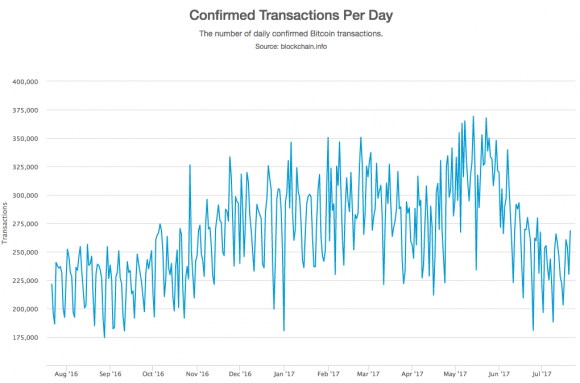

In the second quarter of 2017, Bitcoin prices skyrocketed from $1,200 to more than $2,000.

-

- On May 20, 2017, the price of one Bitcoin passed $2,000 U.S. for the first time.

- Mexican exchange Bitso saw trading volume increase 1,500 percent for the 6-month period ending March 2017,

- Between January and May 2017, Poloniex saw an increase of more than 600 percent in active Bitcoin traders online.

- The value of 1 Bitcoin (BTC) reached over US $1,800 on May 11th, 2017.

- On May 1, 2017, the value of 1 BTC reached US $1,402.03.

- In March 2017, the number of GitHub projects related to Bitcoin passed 10,000.

- BitPay CEO Steph

en Pair declared the company’s transaction rate grew three times from January 2016 to February 2017, saying usage of Bitcoin B2B supply chain payments up and growing..

en Pair declared the company’s transaction rate grew three times from January 2016 to February 2017, saying usage of Bitcoin B2B supply chain payments up and growing.. - In January 2017, NHK reported the number of online stores accepting Bitcoin in Japan had increased by nearly a factor of five over the past year.

- In the first half of 2017, 1 Bitcoin surpassed the spot price of an ounce of gold for the first time, and subsequently broke its all-time high.

-

In November 2016, the Swiss Railway operator SBB (CFF) upgraded all their automated ticket machines to support Bitcoin.

- By September 2016, the number of Bitcoin ATMs reached 771 worldwide.

-

An Australian by the name of Craig Wright stepped forward in 2016 to say that he was the mysterious Nakamoto. Is he? It’s not clear. Wright changed his mind about trying to prove his identity not long after he came out claiming it.

- In August 2016, a major Bitcoin exchange, Bitfinex, was hacked and nearly 120,000 BTC was stolen.

- In July 2016, researchers published a paper showing that by November 2013, Bitcoin commerce was no longer driven by “sin” activities but instead by legitimate enterprises.

- In July 2016, Uber switched to Bitcoin in Argentina — after the government blocked credit card companies from dealing with Uber.

In June 2016, the London Review of Books published a piece by Andrew O’Hagan about Nakamoto.

In June 2016, the London Review of Books published a piece by Andrew O’Hagan about Nakamoto.- In May 2016, Gatecoin closed temporarily after a breach had caused a loss of about $2 million in cryptocurrency.

- In April 2016, Steam started accepting Bitcoin as payment for video games and other online media.

- In March 2016, the Cabinet of Japan recognized virtual currencies like Bitcoin as having a function similar to real money.

- In 2016, BidorBuy, the largest South African online marketplace, launched Bitcoin payments for both buyers and sellers.

- The US-based exchange Cryptsy declared bankruptcy in January 2016, ostensibly because of a 2014 hacking incident; the court-appointed receiver later alleged that Cryptsy’s CEO had stolen $3.3 million.

- In January 2016, the Bitcoin network rate exceeded 1 exahash/sec.

- As 2015 ended, the price of 1 Bitcoin was $426 — and 4730 people viewed the Bitcoin article on Wikipedia.

- The number of research papers on Google Scholar mentioning Bitcoin in 2015: 3,670

- As of August 2015, some 160,000 merchants accepted Bitcoin payments, according to estimates.

- In April 2015, payment processors BitInstant and Mt. Gox experienced processing delays due to insufficient capacity, resulting in the Bitcoin exchange rate dropping from $266 to $76 before returning to $160 within six hours.

- April 2015: Bitcoin increased its public profile after OkCupid and Foodler began accepting it for

payment.

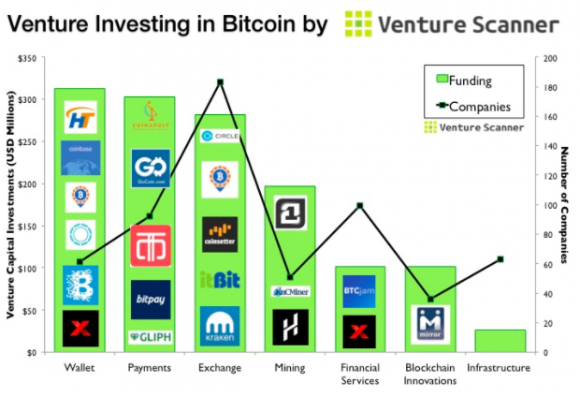

payment. - In March 2015, 21 LLC announced it had raised 116 million USD in venture funding, the largest amount for any digital currency-related companies.

- March 2015: The UK Treasury’s a information on digital currency are announced.

- Chinese cryptocurrency exchange Bter lost $2.1 million in BTC in February, 2015.

- Bitcoin prices declined to just over $200 in early 2015.

- In 2015, Barclays announced that they would become the first UK high street bank to start accepting Bitcoin.

- January 4, 2015: Bitstamp goes offline after $5 million worth of Bitcoin are stolen. The exchange is operational five days later.

- January 2015: The New York Stock Exchange becomes a minority investor in Coinbase’s $75M funding round. The NYSE aims to tap into the new asset class by bringing transparency, security and confidence to Bitcoin.

- In January 2015, Coinbase raised 75 million USD as part of a Series C funding round, smashing all previous records for a Bitcoin company.

- As 2014 ended, the price of 1 Bitcoin was $314 and 6162 people viewed the Wikipedia page.

-

December 11, 2014: Microsoft begins accepting Bitcoin for Xbox games and Windows apps.

- October 2014: TeraExchange announces that the first Bitcoin derivative transaction was executed on a regulated exchange, adding a new hedging instrument to Bitcoin and instilling credibility and institutional confidence in the entire Bitcoin community.

September 23, 2014: PayPal allows its merchants to accept Bitcoin payments.

September 23, 2014: PayPal allows its merchants to accept Bitcoin payments.- In September 2014, TeraExchange, LLC, received approval from the U.S.Commodity Futures Trading Commission “CFTC” to begin listing an over-the-counter swap product based on the price of a Bitcoin. The CFTC swap product approval marks the first time a U.S. regulatory agency approved a Bitcoin financial product.

- The Consumer Financial Protection Bureau issued guidance against the risks of Bitcoin in August of 2014.

- August, 2014: The Chancellor of the Exchequer, George Osborne, demonstrates his and HM Treasury’s positive outlook on Bitcoin when he purchases £20 worth of Bitcoin and announces HM Treasury’s Call for Information on digital currencies, offering digital currency businesses the chance to comment on the risks and benefits and potentially influence future government policy.

- 2014: The European Banking Authority publishes its opinion on ‘virtual currencies’. Their analytical report recommends that EU legislators consider declaring virtual currency exchanges as ‘obliged entities’ must comply with anti-money laundering (AML) and counter-terrorist financing requirements.

- June 27, 2014: The US Marshals auction off the Bitcoin they seized in a Silk Road raid.

- July 17, 2014: The New York State Department of Financial Services issues a BitLicense proposal.

- In July 2014, NewEgg started accepting Bitcoin.

- July 2014: Dell started accepting Bitcoin.

- In June 2014, the Bitcoin network exceeded 100 petahash/sec.

- On 18 June 2014, it was announced that Bitcoin payment service provider BitPay would become the new sponsor of the St. Petersburg Bowl game under a two-year deal, renamed the Bitcoin St. Petersburg Bowl.

- 50. May 8, 2014: The FEC rules that Bitcoin contributions to political committees are legal, provided the amount is less than $100.

- Bitcoin prices fell to around $400 in April 2014.

-

The IRS classified Bitcoin as property in most contexts in March 2014.

- In 2014, the U.S. Securities and Exchange Commission filed an administrative action against Erik T. Voorhees, for violating Securities Act Section 5 for publicly offering unregistered interests in two Bitcoin websites in exchange for Bitcoins.

- In March of 2014, David Cohen — the undersecretary for terrorism and financial intelligence at the Unite States Department of the Treasury — stated that virtual currencies are not leading to widespread criminal use.

- March 6, 2014: Newsweek publishes an article claiming to have identified Bitcoin’s creator.

- On March 3, 2014, Flexcoin announced it was closing its doors because of a hack attack that took place the day before.

- February 28, 2014: Mt. Gox files for bankruptcy protection after losing $450 million worth of Bitcoin. The CEO was eventually arrested and charged with embezzlement.

- February 2014: HMRC classifies Bitcoin as assets or private money, meaning that no VAT will be charged on the mining or exchange of Bitcoin. This is important as it is the world’s first and most progressive treatment of Bitcoin, positioning the UK government as the most forward thinking and comprehensive with regard to Bitcoin taxation.

- January 26, 2014: Charlie Shrem, CEO of Bitinstant, is arrested for money laundering.

- In January 2014, Zynga announced it was testing Bitcoin for purchasing in-game assets in seven of its games.

- January 2014: The D Las Vegas Casino Hotel and Golden Gate Hotel & Casino properties in downtown Las Vegas announced they would begin accepting Bitcoin.

- January 2014: The Bitcoin network rate exceeded 10 petahash/sec.

- January, 2014: TigerDirect started accepting bitcoin.

- January 9, 2014: Overstock.com becomes the first major online retailer to embrace Bitcoin.

-

January 2014: Bitcoin custodians Elliptic launch the world’s first insured Bitcoin storage service for institutional clients.

- As 2013 ended, the price of 1 Bitcoin was $764 and 26354 people viewed the Wikipedia page.

- The number of Google Scholar articles published mentioning Bitcoin in 2013: 1,390

- So far, anyway, 2013 was the most tumultuous years for Bitcoin.

- 2013: Mt. Gox, the Japan-based Bitcoin exchange, handled 70 percent of all worldwide bitcoin traffic.

- The year 2013 saw hundreds of these new altcoins launch. Some for scams, but many are still in trading today.

- December 18, 2013: BTC China says it can no longer accept deposits, causing the price to plunge 38 percent in a day.

-

December 4, 2013: China’s central bank announces that financial institutions are prohibited from exchanging Bitcoin, causing the price to dip below $1,000.

- November 27, 2013: The Bitcoin price tops $1,000, bringing total market capitalization to over $10 Billion.

- November 18, 2013: Bitcoin price climbs to $700 as the US Senate holds its first hearings on the digital currency. The Federal Reserve chairman at the time, Ben Bernanke, gives his blessing to bitcoin. In his letter to the Senate homeland security and government affairs committee, Bernanke states that Bitcoin “may hold long-term promise, particularly if the innovations promote a faster, more secure and more efficient payment system.”

- In November 2013, the University of Nicosia announced that it would be accepting Bitcoin as payment for tuition fees, with the university’s chief financial officer calling it the “gold of tomorrow.”

During November 2013, the China-based Bitcoin exchange BTC China overtook the Japan-based Mt. Gox and the Europe-based Bitstamp to become the largest Bitcoin trading exchange by trade volume.

During November 2013, the China-based Bitcoin exchange BTC China overtook the Japan-based Mt. Gox and the Europe-based Bitstamp to become the largest Bitcoin trading exchange by trade volume.- Two companies, Robocoin and Bitcoiniacs launched the world’s first Bitcoin ATM on 29 October 2013 in Vancouver, BC, Canada.

- In 2013, Chinese internet giant Baidu had allowed clients of website security services to pay with Bitcoins.

- On 26 October 2013, a Hong-Kong based Bitcoin trading platform owned by Global Bond Limited (GBL) vanished with 30 million yuan (US$5 million) from 500 investors.

- October 1, 2013: The Silk Road website is shut down.

- In October 2013, Inputs.io, an Australian-based Bitcoin wallet provider, was hacked with a loss of 4100 Bitcoins, worth over A$1 million at time of theft.

- August, 2013: Federal Judge Mazzant claims: “It is clear that Bitcoin can be used as money” and “It can be used to purchase goods or services” in a case against Trendon Shavers, the so-called ‘Bernie Madoff of bitcoin’.

- August, 2013: Bloomberg begins testing Bitcoin data on its terminal.

-

On 11 August 2013, the Bitcoin Foundation announced that a bug in a pseudorandom number generator within the Android operating system had been exploited to steal from wallets generated by Android apps.

- In August 2013, the German Finance Ministry characterized Bitcoin as a unit of account, usable in multilateral clearing circles and subject to capital gains tax if held less than one year.

- In July 2013, the industry group Committee for the Establishment of the Digital Asset Transfer Authority began to form to set best practices and standards, to work with regulators and policymakers to adapt existing currency requirements to digital currency technology and business models and develop risk management standards.

- In July 2013, a project began in Kenya linking Bitcoin with M-Pesa, a popular mobile payments system, in an experiment designed to spur innovative payments in Africa.

July, 2013: The Foreign Exchange Administration and Policy Department in Thailand stated that Bitcoin lacks any legal framework and would therefore be illegal.

July, 2013: The Foreign Exchange Administration and Policy Department in Thailand stated that Bitcoin lacks any legal framework and would therefore be illegal.- June, 2013: The first major Bitcoin theft takes place. Bitcoin Forum founder reports having 25,000 BTC taken from his digital wallet, which had an equivalent value of $375,000 at the time.

- On 23 June 2013, it was reported that the US Drug Enforcement Administration listed 11.02 Bitcoins as a seized asset. It is the first time a government agency has claimed to have seized Bitcoin.

- June 2013: A major breach of security sees the value of Bitcoin go from $17.51 to $0.01 per Bitcoin.

- In June 2013, Bitcoin Foundation board member Jon Matonis wrote in Forbes that he received a warning letter from the California Department of Financial Institutions accusing the foundation of unlicensed money transmission. Matonis denied that the foundation is engaged in money transmission and said he viewed the case as “an opportunity to educate state regulators.”

- May 14, 2013: Feds seize bitcoin from Mt. Gox for illegally operating as a money transmitter.

-

On April 3, 2013, Instawallet was hacked, resulting in the theft of over 35,000 bitcoins.

- An April 2013 report in Wired showed that 45 percent of Bitcoin exchanges end up closing.

- April 2013: BitInstant facilitated 30,000 Bitcoin transactions.

- March 28, 2013: Bitcoin market capitilization hits $1 billion.

- On 17 May 2013, it was reported that BitInstant processed approximately 30 percent of the money going into and out of Bitcoin.

- In 2013, the U.S. Treasury extended its anti-money laundering regulations to processors of Bitcoin transactions.

- March 18, 2013: The US Financial Crimes Enforcement Network (FINCEN) issues some of the world’s first Bitcoin regulation in the form of a guidance report for persons administering, exchanging, or using virtual currency. This marked the beginning of an ongoing debate on how best to regulate bitcoin.

- March, 2013: As Cyprus faces dire conditions for a bailout package, Bitcoin’s price soars.

- March 12, 2013: A previously undiscovered protocol rule results in a hard fork of the 0.8.0 reference client… A Bitcoin miner running version 0.8.0 of the Bitcoin software created a large block that was considered invalid in version 0.7 (due to an undiscovered inconsistency between the two versions). This created a split or “fork” in the blockchain since computers with the recent version of the software accepted the invalid block and continued to build on the diverging chain, whereas older versions of the software rejected it and continued extending the blockchain without the offending block. This split resulted in two separate transaction logs being formed without clear consensus, which allowed for the same funds to be spent differently on each chain.

-

Until 2013 almost all markets with Bitcoins were in US dollars.

- In February 2013, the Bitcoin-based payment processor Coinbase reported selling US$1 million worth of Bitcoins in a single month at over $22 per bitcoin.

- As 2012 ended, the price of 1 Bitcoin was $13.44 and 2809 people viewed the Wikipedia page.

- The number of Google Scholar articles published mentioning Bitcoin in 2012: 424

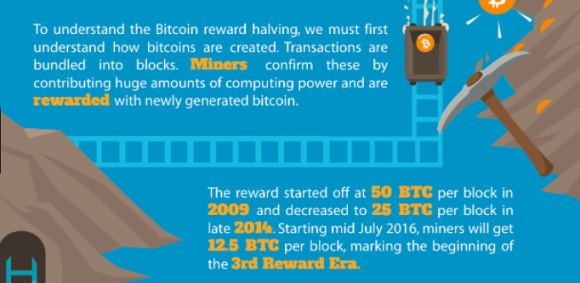

- November 28, 2012: The first “Halving Day” occurs, causing the block reward given to miners to decrease by 50%.

-

In November 2012, WordPress began accepting Bitcoins.

- In its October 2012 study, Virtual Currency Schemes, the European Central Bank concluded that the growth of virtual currencies will continue, and, given the currencies’ inherent price instability, lack of close regulation, and risk of illegal uses by anonymous users, the Bank warned that periodic examination of developments would be necessary to reassess risks.

- In October 2012, BitPay reported that more than 1,000 merchants were accepting Bitcoin under its payment processing service.

-

In September 2012, the Bitcoin exchange Bitfloor, reported a hack. Some 24,000 Bitcoins were stolen.

- Bitcoinica was hacked twice in 2012, which led to allegations that the venue neglected the safety of customers’ money and cheated them out of withdrawal requests.

- In September 2012, the Bitcoin Foundation was launched to “accelerate the global growth of bitcoin through standardization, protection, and promotion of the open source protocol.”

- In late August 2012, an operation titled Bitcoin Savings and Trust was shut down by the owner, leaving around US$5.6 million in Bitcoin-based debts; this led to allegations that the operation was a Ponzi scheme.

-

March 1, 2012: A security breach in web host Linode results in the theft of 50,000 Bitcoins.

- In 2012, the Cryptocurrency Legal Advocacy Group (CLAG) stressed the importance for taxpayers to determine whether taxes are due on a Bitcoin-related transaction based on whether one has experienced a “realization event.”

In January 2012, Bitcoin was featured as the main subject within a fictionalized trial on the CBS legal drama The Good Wife in the third-season episode “Bitcoin for Dummies.” The host of CNBC’s Mad Money, Jim Cramer, played himself in a courtroom scene where he testifies that he doesn’t consider Bitcoin a true currency, saying, “There’s no central bank to regulate it; it’s digital and functions completely peer to peer.”

In January 2012, Bitcoin was featured as the main subject within a fictionalized trial on the CBS legal drama The Good Wife in the third-season episode “Bitcoin for Dummies.” The host of CNBC’s Mad Money, Jim Cramer, played himself in a courtroom scene where he testifies that he doesn’t consider Bitcoin a true currency, saying, “There’s no central bank to regulate it; it’s digital and functions completely peer to peer.”- 118As 2011 ended, the price of 1 Bitcoin was $4.60 and 2185 people viewed the Wikipedia page.

- The number of Google Scholar articles published mentioning Bitcoin in 2011: 218

- In September 2011, Vitalik Buterin co-founded Bitcoin Magazine.

- In August 2011, MyBitcoin declared that it was hacked, which caused it to be shut down.

- In July 2011, the operator of Bitomat, the third-largest Bitcoin exchange, announced that he had lost access to his wallet.dat file with about 17,000 Bitcoins.

- June, 2011: Each Bitcoin is worth $31, giving the currency a market cap of $206 million.

- On 19 June 2011, a security breach of the Mt. Gox Bitcoin exchange caused the nominal price of a Bitcoin to fraudulently drop to one cent on the exchange, after a hacker used credentials from a Mt. Gox auditor’s compromised computer illegally to transfer a large number of Bitcoins to himself.

- April 16, 2011: Time magazine introduces Bitcoin to its readers..

- In April 2011, Nakamoto communicated with a Bitcoin contributor, saying that he had “moved on to other things”.

-

February 2011: Bitcoin reaches parity with the US dollar for the very first time.

In 2011, the first alternative digital currency or “altcoin,”Litecoin, launched.

In 2011, the first alternative digital currency or “altcoin,”Litecoin, launched.- January, 2011: The Silk Road, an illicit drugs marketplace is established, using Bitcoin as an untraceable way to buy and sell drugs online.

- The Electronic Frontier Foundation, a non-profit group, started accepting Bitcoins in January 2011.

- 2011: Based on Bitcoin’s open source code, other cryptocurrencies started to emerge.

- From 2010 until February of 2014, Mt.Gox’s price was commonly referred to as the price of Bitcoin with only a few exceptions.

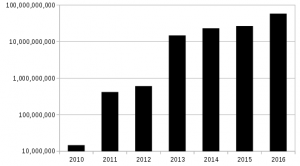

- The number of Google Scholar articles published mentioning Bitcoin in 2010: 136

- November 6, 2010: Bitcoin economy surpasses $1 million; value of a bitcoin reaches $0.50 on the Mt. Gox exchange.

- Nakamoto’s Bitcoin involvement doesn’t appear to extend past mid-2010, according to reports.

- October 2010: Bitcoin goes under the spotlight. After the hack in August – and a subsequent discovery of other vulnerabilities in the blockchain in September – an inter-governmental group publishes a report on money laundering using new payment methods. Bitcoin, it suggested could help people finance terrorist groups.

- August 15, 2010: A hacker exploits a vulnerability in the Bitcoin-core software and creates 184 billion bitcoins, leading to the first blockchain fork.

- August, 2010: The value of the Bitcoin drops through the floor.

- On 6 August 2010, a major vulnerability in the bitcoin protocol was spotted. Transactions weren’t properly verified before they were included in the transaction log or blockchain, which let users bypass Bitcoin’s economic restrictions and create an indefinite number of Bitcoins.

- May 22, 2010: The price of two pizzas is negotiated at Bitcoin Talk Forum for 10,000 BTC, marking the first Bitcoin transaction.

- February, 2010: The world’s first Bitcoin market is established by the now defunct dwdollar.

- The number of Google Scholar articles published mentioning Bitcoin in 2009: 83

October 5, 2009: New Liberty Standard generates the first USD/BTC exchange rate at $1 = 1,309.03 BTC.

October 5, 2009: New Liberty Standard generates the first USD/BTC exchange rate at $1 = 1,309.03 BTC.- January 12, 2009: First Bitcoin transaction takes place when Satoshi Nakamoto sends 10 BTC to Hal Finney.s

- January 9, 2009: Bitcoin v0.1 is released.

- In January 2009, the Bitcoin network came into existence with the release of the first open source Bitcoin client and the issuance of the first Bitcoins, with a person calling himself or herself Satoshi Nakamoto mining the first block of Bitcoins ever (the Genesis Block). The reward was 50 Bitcoins.

- November 2008: Nakomoto posts a detailed Bitcoin white paper, “Bitcoin: A Peer-to-Peer Electronic Cash System,” to a cryptocurrency news list.

Read that first paper here .. or listen to it, below.

For aNewDomain, I’m Brian D. Colwell.

Cover image: Coindesk.com, All Rights Reserved. Inset images: First Bitcoin ATM story in 2017: YouTube, All Rights Reserved. All charts: Blockchain.info, All Rights Reserved, Disruptive.asia, All Rights Reserved.