aNewDomain — I am a stickler for tracking my income and expenses. It’s just in my nature. But I’ve been tracking my finances manually using Excel worksheets (at one time it was Lotus 123) for years. It’s more than a bit tedious and in no way mobile-enabled, so I am long overdue for an update.

Mint, from Intuit, is an excellent candidate for bringing my obsession for tracking finances into the modern mobile-app universe. Perhaps it will work for you, too. Get the mobile version for Android on Google Play and Apple iOS, or access Mint through a web browser.

Make It Count

Tracking and managing your financial transactions is a responsibility that is too often ignored. When you forget to pay the utility bill, and they cut your power off, there’s no one to blame but yourself — it’s your responsibility to pay your bills. But that doesn’t mean you have to keep up with dozens of worksheets like I do.

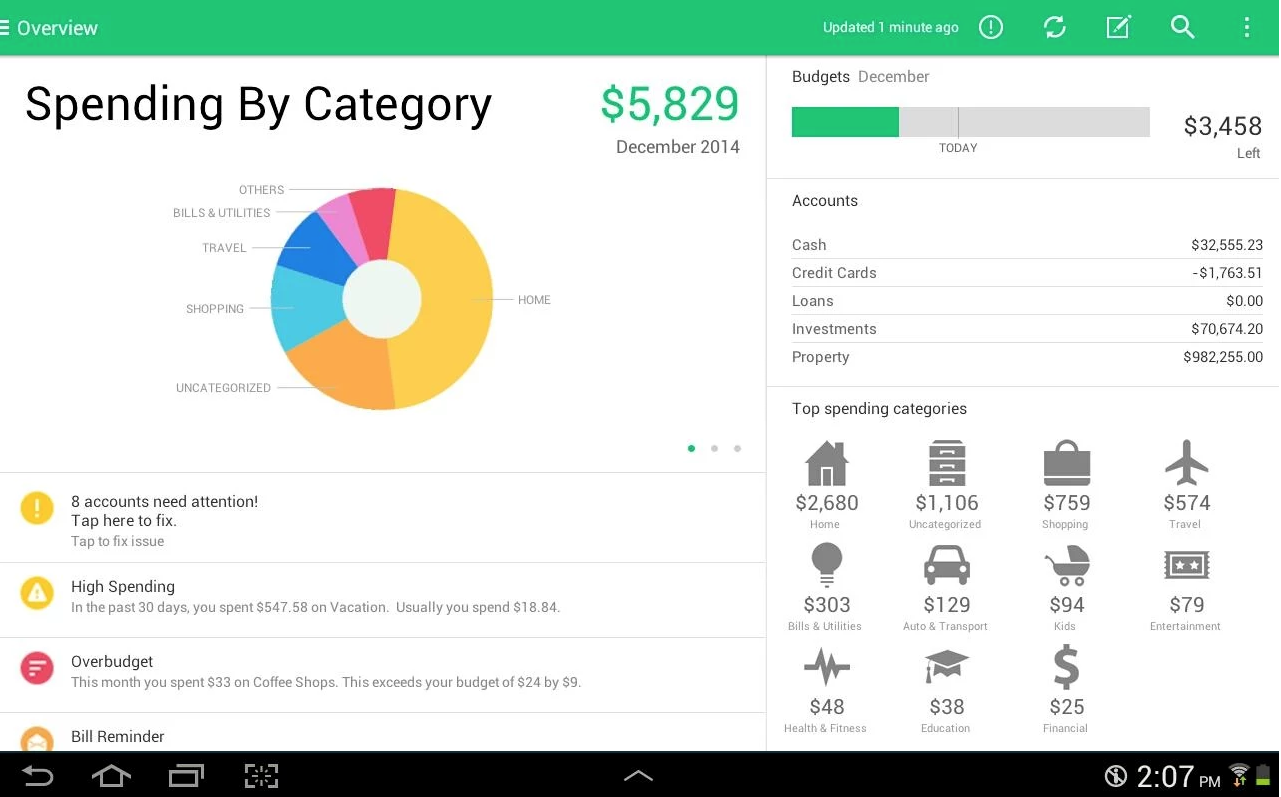

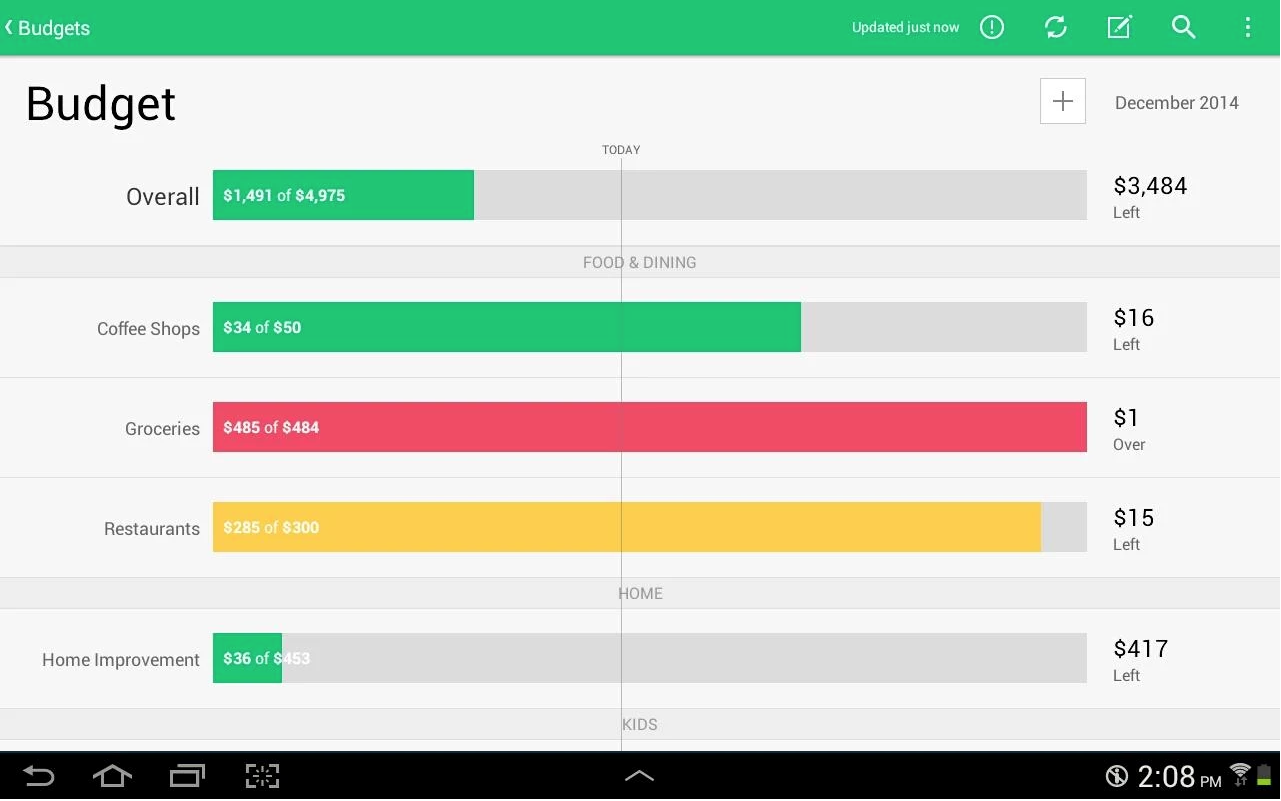

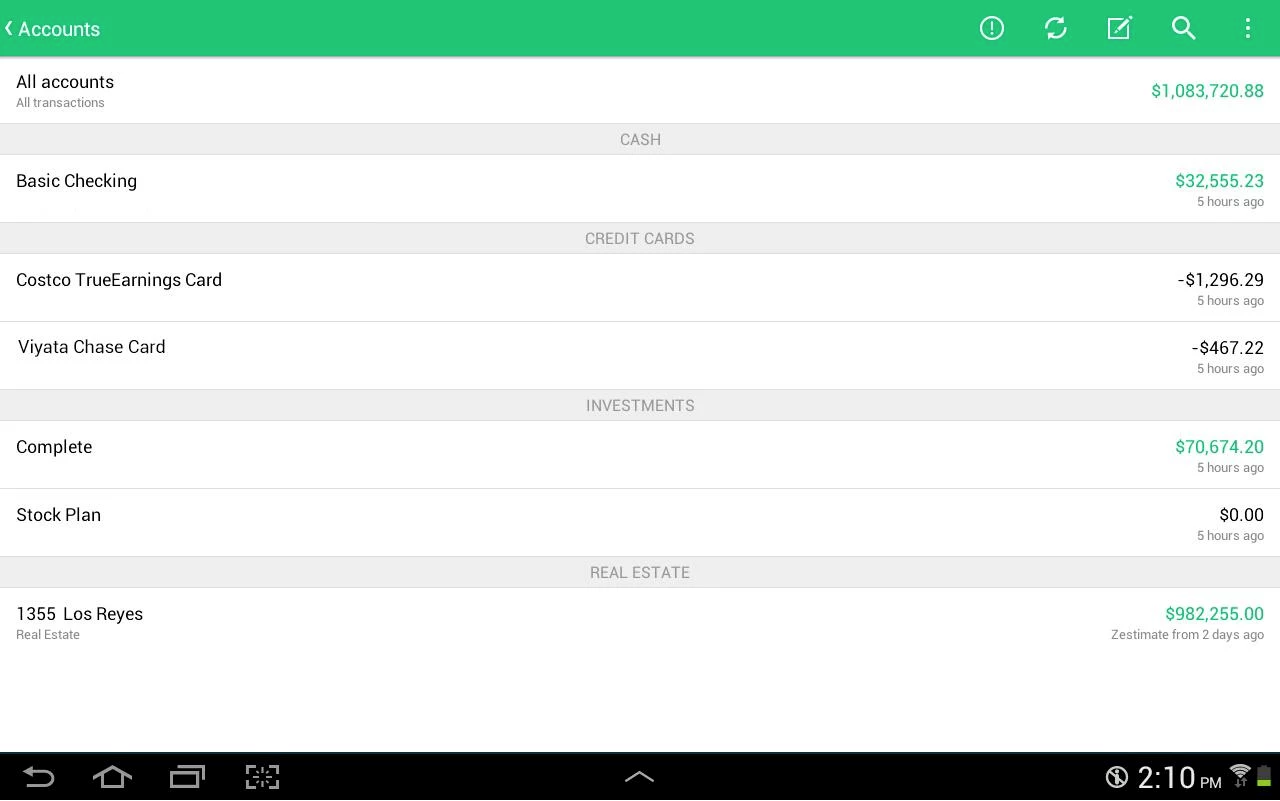

A system like Mint can automate much of the mundane data entry and number crunching for you by directly contacting the financial institutions where the transactions are first recorded. The only mundane part you have to do is enter in the initial information — Mint will take it from there.

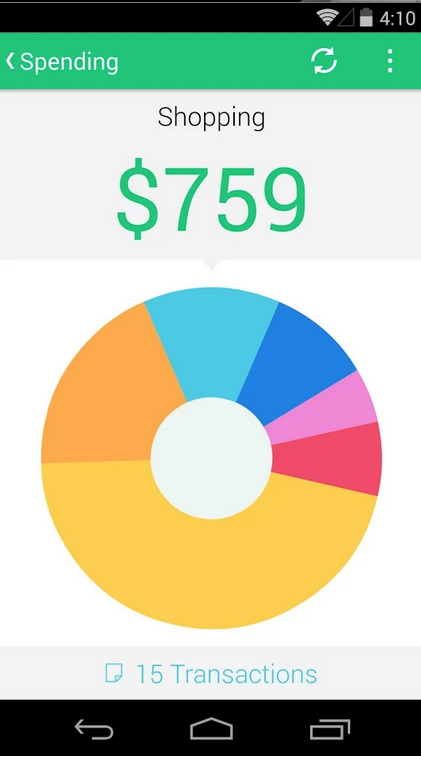

Mint will keep up with your financial activity in real time, which means you can find out exactly what is happening in your financial world instantly from your computer or mobile device of choice. Wondering if you can afford to take a date to that great concert you just heard about? A quick check with your Mint account can tell you.

Mint doesn’t charge any fees for using its service. Instead, Intuit makes its money through advertising and deals with financial institutions and other interested third-parties, like the people who track your credit score.

Security

Security is my greatest concern with services like Mint. While you have the usual security measures like passwords and PIN info, there’s more than a little trepidation about giving an online service access to your financial information, especially since that information is automated and updated in real time. With the push of a few buttons, a stolen smartphone could reveal all of your financial information to a stranger with malicious intent.

The counter to this security threat is two-fold. First off, the Mint service cannot initiate a financial transaction, it can only record and report on transactions you have conducted with other sources. So, a nefarious person could not transfer money from your checking account using Mint alone.

Second, a Mint user can completely delete the information in their account at any time. In a matter of seconds, all financial information tracked by Mint can be removed from the system, and the account can be locked. Of course, that means to get your financial life back in order with Mint, you’ll have to start over, but in the long run that’s a small price to pay for the sake of information security.

Bottom Line

Keeping track of your financial transactions is your responsibility — no one else is going to do it for you. But using an app like Mint can make personal financial management more automated and much less tedious if you’re willing to commit to the services it provides. And because Mint charges no fees, it’s free to try (and use) — so there’s really no excuse not to check it out.

For aNewDomain, I’m Mark Kaelin.

Featured image: Mint by Anthony Cramp via Flickr

All screenshots: Mark Kaelin courtesy of Google Play