aNewDomain — Fourteen banks, hedge funds and financial firms have invested almost $70 million in a new communications tool called Symphony Communication Services. Symphony is a tool to hide text messages, chat transcripts and other messages from banking regulators, those who could use such communication as key evidence in criminal investigations. As you might guess, it is awfully controversial.

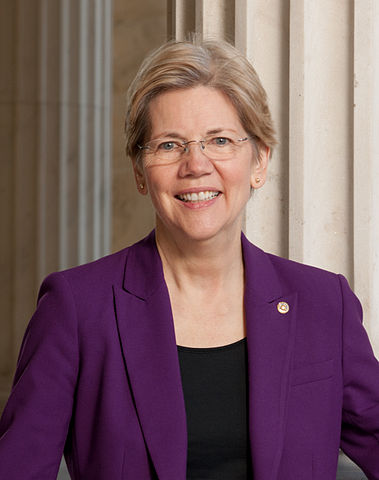

Here is the blog post from Symphony titled “How We’ve Improved Secure Business Communications for the 21st Century Workforce.” The post originally implied the service could be used to evade government oversight. But such language was taken off the site this week, following a letter from U.S. Massachusetts Senator Elizabeth Warren to large banks about the Symphony system. She wrote:

Here is the blog post from Symphony titled “How We’ve Improved Secure Business Communications for the 21st Century Workforce.” The post originally implied the service could be used to evade government oversight. But such language was taken off the site this week, following a letter from U.S. Massachusetts Senator Elizabeth Warren to large banks about the Symphony system. She wrote:

My concerns are exacerbated by Symphony’s publicly available descriptions of the new communications system, which appear to put companies on notice – with a wink and a nod – that they can use Symphony to reduce compliance and enforcement concerns.”

Symphony is backed by the biggest names in finance, including Goldman Sachs, Morgan Stanley, JPMorgan Chase and Blackrock. These investment houses have taken stakes totaling billions of dollars in the company, slated to become broadly available in September.

Senator Warren continued:

Today I sent letters to six of the banking regulatory agencies, asking for information about the impact of this system on their ability to enforce the law.”

Is the review necessary, following the 2008 implosion and its investigative aftermath that led to the Great Recession?

Is the review necessary, following the 2008 implosion and its investigative aftermath that led to the Great Recession?

Billions of dollars were payed out by fines, yet it’s not clear that all the tricks and camouflaged “new finance tools” were discovered.

Yes, it is. Here’s why.

The invisible nature of financial crimes committed by the elites is linked to the relatively unknown or misunderstood body of financial crime. A “victim-less” crime can occur easily, until everything crashes, as happened in 2008.

Researchers say that violations by corporations were:

Based on discreet mechanisms: creative accounting, false financial reports, secret deals, concealed valuations and dangerous products.

One of the reasons behind this invisibility is the absence of direct contact between the perpetrators and their ultimate victims. Unlike with physical offences against people or property, ‘few respondents define themselves as victims of financial fraud or clientelism.'”

When will bankers, or self-imposed “masters of the universe,” remember what a client looks like? When will they recall that a bank needs to be trusted based on transparency and accountability? Encryption means you are hiding from the government and the populace, no matter how you spin it. Who do you trust, Senator Warren or the bankers?

For aNewDomain, I’m David Michaelis.

Images in order

Eye screenshot: courtesy Symphony, All Rights Reserved; Elizabeth Warren: via Wikimedia Commons; Screenshot from: Symphony PR document, All Rights Reserved.