Whoever gets the most data wins.

Masayoshi Son, 2017 Softbank World conference

aNewDomain — The race to win the global satellite constellation race to provide global Internet service is on. I’ve already given you an update on what SpaceX is up to in this regard.

aNewDomain — The race to win the global satellite constellation race to provide global Internet service is on. I’ve already given you an update on what SpaceX is up to in this regard.

This week, I looked into what’s going down with low-earth satellite leader, OneWeb.

Back in 2003, Wyler’s firm, Terracom, signed a contract to connect Rwandan schools, government institutions, and homes. It failed to meet its goal due to diffulties in handling Earth-bound infrastructure, which led Wyler to focus on what he’s doing now: Solving the problem via satellite.

Wyler took the first big step toward this goal in 2007, when he founded O3b Networks, a firm that provides ISPs with high-speed connectivity using a constellation of 12 LEO(tk) satellites orbiting at 8,012 km above the equator. In spite of its name, though, O3b isn’t capable of connecting the entire world. OneWeb, which he founded in 2012, has taken up that mission to bridge the digital divide, which he thinks it may actually do by 2027.

Wyler took the first big step toward this goal in 2007, when he founded O3b Networks, a firm that provides ISPs with high-speed connectivity using a constellation of 12 LEO(tk) satellites orbiting at 8,012 km above the equator. In spite of its name, though, O3b isn’t capable of connecting the entire world. OneWeb, which he founded in 2012, has taken up that mission to bridge the digital divide, which he thinks it may actually do by 2027.OneWeb vs SpaceX

OneWeb and SpaceX have the same goal so far as that goes, but the two organizations are otherwise dissimilar. SpaceX is integrated in the same way Apple was when it entered the computer business in the mid 1970s: It is building the rockets, satellites and ground stations themselves. OneWeb is more like IBM in the early PC business, utilizing a long list of hardware and software partners that bring outside skills and funds to the project. For instance, as I mentioned, Qualcomm will design and supply communication chips and Airbus will manufacture satellites. It’s an arrangement that frees up OneWeb to focus on a myriad of other issues ahead.

OneWeb, it’s worth noting, also enjoys a symbiotic relationship with Softbank, its single largest investor. SoftBank’s Vision Fund has invested $1 billion in OneWeb.

At the 2017 SoftBank World conference earlier this year, founder and CEO Masayoshi Son outlined his vision of the future that is grounded in his idea, he said, that “whoever gets the most data wins.”

Several Vision Fund investments focus on collecting that training data from Internet of things (IoT) devices. They have invested in ARM, which dominates the IoT and smartphone processor markets, Nvidia which makes processors used in AI, Boston Dynamics which is building intelligent robots and, you guessed it, OneWeb, which will link 1 trillion IoT devices to AI projects.

Wyler and representatives of some other Vision Fund companies made presentations during the keynote, where they talked up the fact their priority rights to 3.55 Ghz of globally harmonized spectrum for non-geostationary satellites and a new, proprietary technique for avoiding intereference with geo-stationary satellites when over the equator.

Wyler and representatives of some other Vision Fund companies made presentations during the keynote, where they talked up the fact their priority rights to 3.55 Ghz of globally harmonized spectrum for non-geostationary satellites and a new, proprietary technique for avoiding intereference with geo-stationary satellites when over the equator.

At the event, Wyler and other reps revealed that OneWeb and its manufacturing partner, Airbus, have devised a new way of mass producing satellites, which obviates the need for slow, manual building. Capable of connecting both Internet gateways and end user, the first satellites will cost under a million a piece and roll off the line at the rate of three a day.

As for the specs, Wyler claims the satellites will have a capacity of 565Mbps to begin with, which will increase to 1Gbps levels down the line.

The Key Variable? System Capacity

System capacity is a key variable. OneWeb claimed satellite throughput would be “up to” 7.5 Gbps in a June 2016 presentation to the ITU, but Wyler quoted much lower capacity in his Softbank talk. (I’ve asked OneWeb for clarification on this change, but have not received a reply. I will update this post if and when I do).

That revised capacity estimate may explain Wyler’s Feb, 2017 statement that OneWeb had sold a considerable portion of the capacity of its planned constellation. The following month it filed an application with the FCC for an additional 720 satellites orbiting at 1,200 km and 1,280 orbiting at 8,500 km.

What the planned customer mix is in this scenario is as yet unclear. Presumably, it’ll come out the gate to serve Internet gateways requiring considerable bandwidth. End users at home and school will require less bandwidth, but there will be more of them. There will be large numbers of IoT devices, but they will require little bandwidth. Population densities also vary greatly — between urban and rural areas, continents and islands and, in the extreme, ships at sea.

One Gbps will go a lot further in Alaska than Bangladesh.

And if OneWeb hits its latency goals of under 50ms, those users will find that interactive applications like 5G mobile telephony, game playing and Web surfing run really decently.

Considering all this, it does appear that OneWeb at this moment is well ahead of SpaceX’s schedule. According to the company, the first satellites will launch in March 2018, which satisfies the ITU spectrum use requirement. Service is scheduled to commence in areas of Alaska in 2019, with all-Alaska coverage in place by the end of 2020.

By 2025, the goal is to get to the one billion subscriber mark. Will OneWeb live up to all those promises? Will SpaceX catch up? This new space race will be well worth watching, and I’ll be right here keeping score for you as it proceeds.

Stay tuned.

For aNewDomain, I’m Larry Press.

The following is a video (9:43) of the presentation. If you’re trying to get your head around this new sector, it’s well worth watching.

(Watch the entire keynote session with presentations by several Vision Fund companies (2:12:15) here.)

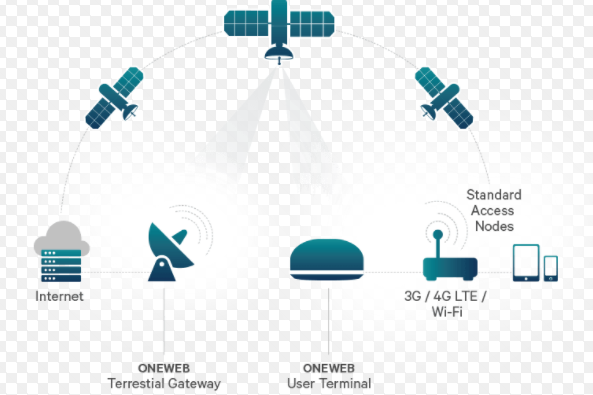

And here’s a slide from OneWeb that presents the architecture of its system, as currently planned.